Regulatory Support for AI Innovations

The Europe Ai Meeting Assistants Market Industry is benefiting from a favorable regulatory environment that encourages AI innovations. The European Union has been proactive in establishing frameworks that promote the development and deployment of AI technologies. Initiatives such as the European AI Strategy aim to foster a competitive AI ecosystem while ensuring ethical standards and data protection. This regulatory support is likely to stimulate investment in AI meeting assistants, as companies seek to comply with evolving regulations while leveraging advanced technologies. Furthermore, the EU's commitment to digital transformation is expected to enhance the market landscape, providing opportunities for AI meeting assistant providers to expand their offerings and reach a broader audience.

Growing Demand for Remote Work Solutions

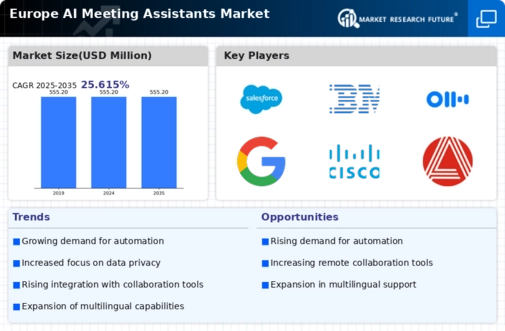

The Europe Ai Meeting Assistants Market Industry is experiencing a notable surge in demand for remote work solutions. As organizations across Europe increasingly adopt flexible work arrangements, the need for efficient meeting management tools has become paramount. According to recent data, approximately 60% of European companies have implemented hybrid work models, which necessitate advanced AI-driven meeting assistants to facilitate seamless communication and collaboration. These tools not only enhance productivity but also help in managing time effectively, thereby addressing the challenges posed by remote work. The growing emphasis on remote work solutions is likely to drive the adoption of AI meeting assistants, as businesses seek to optimize their operations and maintain competitive advantages in a rapidly evolving market.

Increased Focus on Productivity Enhancement

The Europe Ai Meeting Assistants Market Industry is witnessing an increased focus on productivity enhancement among organizations. Businesses are increasingly recognizing the potential of AI meeting assistants to streamline workflows and improve overall efficiency. Recent studies indicate that companies utilizing AI-driven tools report a 30% increase in meeting productivity, as these assistants can automate scheduling, provide real-time transcription, and summarize discussions. This heightened emphasis on productivity is likely to drive the adoption of AI meeting assistants, as organizations strive to maximize their resources and achieve better outcomes. The integration of AI technologies into meeting processes is expected to reshape the way teams collaborate, ultimately leading to a more productive work environment across Europe.

Rising Investment in Digital Transformation

The Europe Ai Meeting Assistants Market Industry is experiencing a surge in investment related to digital transformation initiatives. As organizations across various sectors prioritize the adoption of digital tools, the demand for AI meeting assistants is expected to rise significantly. Recent reports suggest that European companies are projected to invest over 200 billion euros in digital transformation by 2025, with a substantial portion allocated to AI technologies. This influx of investment is likely to accelerate the development and deployment of AI meeting assistants, as businesses seek to enhance their operational efficiency and improve customer engagement. The focus on digital transformation is anticipated to create a robust market environment for AI meeting assistants, fostering innovation and competition among providers.

Growing Emphasis on Collaboration and Communication

The Europe Ai Meeting Assistants Market Industry is characterized by a growing emphasis on collaboration and communication within organizations. As teams become more dispersed and diverse, the need for effective communication tools has intensified. AI meeting assistants are increasingly recognized for their ability to facilitate collaboration by providing features such as agenda management, action item tracking, and integration with various communication platforms. This trend is supported by data indicating that 75% of European employees believe that effective collaboration tools enhance their work experience. The growing emphasis on collaboration is likely to drive the adoption of AI meeting assistants, as organizations seek to foster a culture of teamwork and improve overall communication efficiency.