Integration of Advanced Technologies

The advanced analytics market in Europe is significantly influenced by the integration of cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics. These technologies empower organizations to analyze complex datasets and derive meaningful insights. The European market is witnessing a shift towards more sophisticated analytical tools that can process real-time data, enhancing predictive capabilities. As of 2025, the market for AI-driven analytics solutions is expected to reach €10 billion, reflecting a growing trend among businesses to adopt these technologies. This integration not only streamlines operations but also fosters innovation, thereby propelling the advanced analytics market in Europe.

Growing Importance of Customer Insights

The advanced analytics market in Europe is significantly driven by the growing importance of customer insights in shaping business strategies. Organizations are increasingly utilizing advanced analytics to understand customer behavior, preferences, and trends. This focus on customer-centric approaches enables businesses to tailor their offerings and enhance customer satisfaction. In 2025, it is anticipated that the market for customer analytics solutions will exceed €8 billion, reflecting the critical role of data in informing marketing and product development strategies. As companies strive to build stronger relationships with their customers, the demand for advanced analytics tools that provide deep insights into customer dynamics continues to expand, thereby propelling the advanced analytics market in Europe.

Regulatory Compliance and Data Governance

The advanced analytics market in Europe is increasingly shaped by the need for regulatory compliance and robust data governance frameworks. With stringent regulations such as the General Data Protection Regulation (GDPR) in place, organizations are compelled to adopt advanced analytics solutions that ensure data privacy and security. This regulatory landscape creates a demand for analytics tools that not only provide insights but also adhere to compliance standards. As of 2025, it is projected that compliance-related investments in analytics will account for approximately 30% of the total market expenditure. Consequently, the focus on regulatory compliance is a key driver of the advanced analytics market in Europe.

Rising Demand for Data-Driven Decision Making

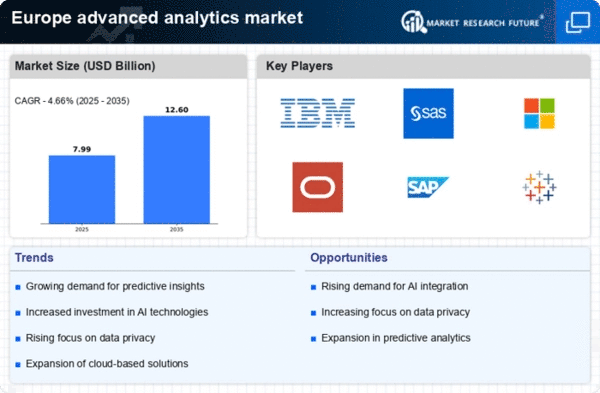

The advanced analytics market in Europe experiences a notable surge in demand as organizations increasingly recognize the value of data-driven decision making. Companies across various sectors are leveraging advanced analytics to enhance operational efficiency and improve customer experiences. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% from 2025 to 2030. This growth is fueled by the need for actionable insights derived from vast amounts of data, enabling businesses to make informed strategic choices. As organizations strive to remain competitive, the integration of advanced analytics into their decision-making processes becomes essential, thereby driving the advanced analytics market in Europe.

Increased Investment in Digital Transformation

The advanced analytics market in Europe is bolstered by a substantial increase in investments directed towards digital transformation initiatives. Organizations are allocating significant budgets to upgrade their analytics capabilities, recognizing the necessity of adapting to the digital landscape. In 2025, it is estimated that European companies will invest over €50 billion in digital transformation, with a considerable portion earmarked for advanced analytics solutions. This investment trend indicates a commitment to harnessing data for competitive advantage, ultimately driving the growth of the advanced analytics market in Europe. As businesses seek to optimize their operations and enhance customer engagement, the demand for advanced analytics tools continues to rise.