Emergence of Predictive Analytics

The advanced analytics market is increasingly characterised by the emergence of predictive analytics, which enables organisations to forecast future trends and behaviours based on historical data. This capability is particularly valuable in sectors such as finance, healthcare, and retail, where anticipating customer needs can lead to significant competitive advantages. The market for predictive analytics is expected to grow substantially, with estimates suggesting a potential increase of 30% in adoption rates over the next few years. This trend indicates a shift towards proactive decision-making, thereby reinforcing the advanced analytics market as a vital component of strategic planning.

Growing Demand for Data-Driven Decision Making

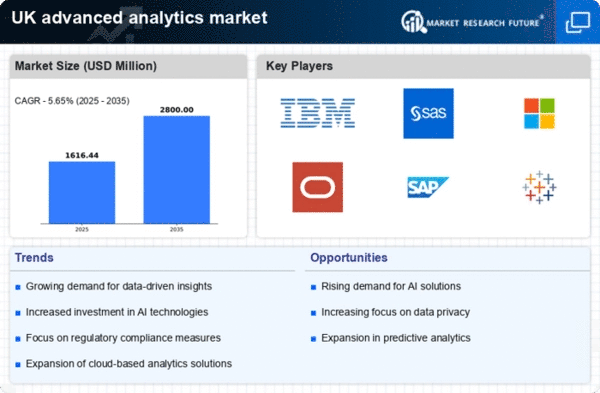

The advanced analytics market in the UK is experiencing a notable surge in demand as organisations increasingly recognise the value of data-driven decision making. This shift is largely attributed to the need for enhanced operational efficiency and competitive advantage. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. Companies are investing in advanced analytics solutions to derive actionable insights from vast datasets, thereby improving their strategic planning and customer engagement. This trend indicates a broader acceptance of analytics as a core component of business strategy, driving the advanced analytics market forward.

Increased Investment in Digital Transformation

The advanced analytics market is benefiting from a significant increase in investment towards digital transformation initiatives across various sectors in the UK. Businesses are allocating substantial budgets to upgrade their technological infrastructure, with a focus on integrating advanced analytics tools. Reports suggest that organisations are expected to spend over £15 billion on digital transformation by 2026, with a considerable portion directed towards analytics capabilities. This investment is crucial for organisations aiming to leverage data for improved customer experiences and operational efficiencies, thus propelling the advanced analytics market to new heights.

Regulatory Compliance and Data Privacy Concerns

As data privacy regulations become more stringent in the UK, organisations are compelled to adopt advanced analytics solutions that ensure compliance while maximising data utility. The advanced analytics market is witnessing a shift towards tools that not only analyse data but also adhere to regulations such as GDPR. This compliance-driven approach is fostering innovation in analytics technologies, as companies seek to balance data insights with privacy requirements. The market is likely to see a rise in demand for analytics solutions that incorporate robust data governance frameworks, thereby enhancing trust and security in data handling.

Collaboration Between Technology Providers and Enterprises

The advanced analytics market is witnessing a growing trend of collaboration between technology providers and enterprises, aimed at developing tailored analytics solutions that meet specific business needs. This partnership approach is fostering innovation and accelerating the deployment of advanced analytics tools across various industries. As organisations seek to harness the full potential of their data, they are increasingly turning to specialised analytics vendors for customised solutions. This collaborative dynamic is likely to enhance the capabilities of the advanced analytics market, driving further growth and adoption in the coming years.