Germany : Strong Infrastructure and Innovation Hub

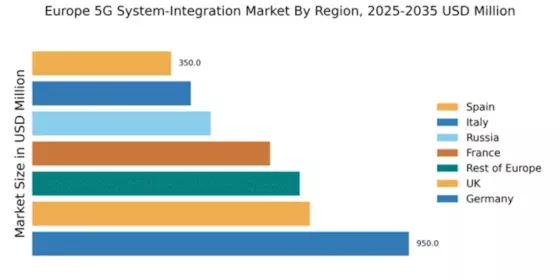

Germany holds a commanding market share of 31.5% in the European 5G system-integration market, valued at $950.0 million. Key growth drivers include robust government initiatives promoting digitalization, significant investments in infrastructure, and a strong industrial base. The demand for high-speed connectivity is surging, particularly in sectors like automotive and manufacturing, supported by favorable regulatory policies that encourage innovation and competition.

UK : Innovation and Investment at Forefront

The UK accounts for 23.3% of the European market, with a value of $700.0 million. Growth is driven by increasing demand for mobile broadband and IoT applications, alongside government support for 5G rollout. The UK government has implemented policies to facilitate infrastructure development, including funding for rural connectivity. The competitive landscape features major players like Ericsson and Nokia, with London and Manchester emerging as key markets for 5G applications in smart cities and healthcare.

France : Strong Regulatory Support and Demand

France holds a 20% market share, valued at $600.0 million. The growth is fueled by government initiatives aimed at enhancing digital infrastructure and promoting 5G adoption across various sectors. Demand is particularly strong in urban areas, driven by smart city projects and enhanced mobile services. Regulatory frameworks are supportive, with the French government actively promoting investment in telecommunications infrastructure, ensuring a conducive environment for market players.

Russia : Strategic Investments and Development

Russia captures 15% of the European market, valued at $450.0 million. Key growth drivers include strategic investments in telecommunications infrastructure and government initiatives aimed at enhancing digital connectivity. Demand is rising in urban centers like Moscow and St. Petersburg, where 5G applications are being piloted. The competitive landscape features local players alongside global giants like Huawei and Ericsson, focusing on sectors such as transportation and public safety.

Italy : Focus on Infrastructure and Innovation

Italy represents 13.3% of the market, valued at $400.0 million. Growth is driven by government initiatives to enhance digital infrastructure and promote 5G technology across various sectors. Demand is particularly strong in metropolitan areas like Milan and Rome, where smart city initiatives are gaining traction. The competitive landscape includes major players like Nokia and Telecom Italia, focusing on applications in healthcare and transportation.

Spain : Investment in Connectivity and Services

Spain holds an 11.7% market share, valued at $350.0 million. The growth is driven by increasing demand for mobile broadband and IoT services, supported by government initiatives to enhance digital infrastructure. Key cities like Madrid and Barcelona are at the forefront of 5G adoption, with applications in tourism and smart city projects. The competitive landscape features major players like Ericsson and Vodafone, focusing on innovative service offerings.

Rest of Europe : Regional Variations and Growth Drivers

The Rest of Europe accounts for 22.5% of the market, valued at $674.5 million. Growth is driven by varying demand across countries, with significant investments in digital infrastructure and government support for 5G initiatives. Countries like the Netherlands and Sweden are leading in adoption, focusing on sectors such as logistics and healthcare. The competitive landscape includes a mix of local and international players, fostering innovation and collaboration.