Germany : Strong Growth and Innovation Hub

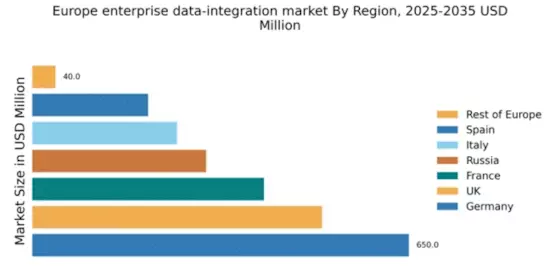

Germany holds a commanding market share of 650.0 million, representing approximately 36.1% of the European enterprise data-integration market. Key growth drivers include a robust industrial base, increasing digital transformation initiatives, and strong government support for technology adoption. The demand for data integration solutions is fueled by the rise of IoT and big data analytics, alongside regulatory frameworks like the GDPR that necessitate efficient data management practices. Infrastructure investments in cities like Berlin and Munich further bolster this growth.

UK : Innovation and Regulatory Challenges

The UK market, valued at 500.0 million, accounts for about 27.8% of the European sector. Growth is driven by the increasing need for real-time data analytics and cloud adoption. The UK government has implemented various initiatives to support tech innovation, including the Digital Strategy, which encourages businesses to adopt data-driven solutions. However, regulatory challenges post-Brexit may impact market dynamics, necessitating compliance with both UK and EU data regulations.

France : Focus on Cloud and AI Solutions

France's enterprise data-integration market is valued at 400.0 million, representing 22.2% of the European total. The growth is propelled by the increasing adoption of cloud services and AI technologies across sectors. Government initiatives like the France 2030 plan aim to enhance digital infrastructure and promote innovation. Demand is particularly strong in urban centers like Paris and Lyon, where tech startups thrive, driving competition among local and international players.

Russia : Regulatory Landscape and Local Demand

Russia's market is valued at 300.0 million, making up 16.7% of the European market. Key growth drivers include the increasing digitization of industries and government initiatives aimed at boosting IT infrastructure. However, regulatory complexities and geopolitical factors pose challenges. Major cities like Moscow and St. Petersburg are central to market activities, with local players like 1C Company competing against international giants such as SAP and Oracle.

Italy : Focus on SMEs and Innovation

Italy's enterprise data-integration market is valued at 250.0 million, accounting for 13.9% of the European market. Growth is driven by the increasing digitalization of SMEs and government support for innovation through initiatives like the National Industry 4.0 Plan. Demand is particularly strong in regions like Lombardy and Emilia-Romagna, where manufacturing and technology sectors are prominent. The competitive landscape includes both local firms and major players like IBM and Microsoft.

Spain : Investment in Digital Transformation

Spain's market is valued at 200.0 million, representing 11.1% of the European total. The growth is fueled by significant investments in digital transformation and cloud computing. Government initiatives, such as the Digital Spain 2025 plan, aim to enhance the country's digital capabilities. Key markets include Madrid and Barcelona, where a vibrant tech ecosystem is emerging. The competitive landscape features both local startups and established players like Oracle and SAP.

Rest of Europe : Diverse Needs Across Regions

The Rest of Europe market is valued at 40.0 million, representing 2.2% of the total European market. This segment includes various smaller markets with unique demands and regulatory environments. Growth is driven by localized needs for data integration solutions, particularly in sectors like healthcare and finance. Countries like Belgium and the Netherlands are seeing increased investments in data management technologies, with local players emerging alongside global giants.