- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

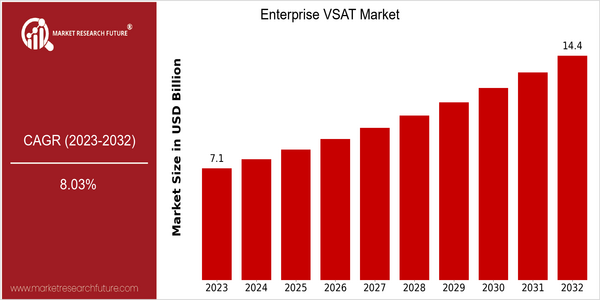

| Year | Value |

|---|---|

| 2023 | USD 7.1 Billion |

| 2032 | USD 14.39 Billion |

| CAGR (2024-2032) | 8.03 % |

Note – Market size depicts the revenue generated over the financial year

Enterprise VSAT (Very Small Aperture Terminal) market is valued at USD 7.11 billion in 2023 and is anticipated to reach USD 14.40 billion by 2032, at a CAGR of 8.03% between 2024 and 2032. The increasing demand for satellite communication solutions from various sectors is driven by the increasing need for dependable communication in remote and underserved areas. The increasing need for VSAT solutions for communication and data transfer has increased as businesses expand their operations across the globe. The growth of the market is also driven by technological advancements, proliferation of IoT devices, and rising demand for high-speed internet services. The use of high-throughput satellites and integration of artificial intelligence in network management are also driving the market growth. Various companies such as Hughes Network System, Viasat, and SES S.A. are undertaking strategic initiatives such as investments in the next-generation satellites and forming new strategic alliances to capitalize on the growing market. These strategic initiatives are aimed at improving the service offerings and expanding the reach of the companies in the changing satellite communication landscape.

Regional Market Size

Regional Deep Dive

Enterprise VSAT market is experiencing a high growth rate in many regions due to the rising demand for reliable and high speed satellite communication solutions. North America has a mature VSAT market with a strong presence of major vendors. The European market is characterized by regulatory support for satellite communications. Asia-Pacific is a rapidly growing market for VSAT services. The rapid growth of telecommunications and Internet services has accelerated the use of VSATs in the region. In the Middle East and Africa, the VSAT market is growing rapidly due to the large investment in communication networks and the government's support for communication development. In Latin America, the demand for satellite solutions in remote areas is increasing.

Europe

- The European Space Agency (ESA) has launched initiatives to promote the use of satellite communications for broadband services, particularly in rural and underserved areas, which is driving demand for VSAT solutions.

- Recent partnerships between satellite operators and telecommunications companies, such as the collaboration between Eutelsat and Orange, are paving the way for innovative VSAT applications, enhancing service offerings and customer reach.

Asia Pacific

- Countries like India and Australia are investing in satellite technology to improve connectivity in remote regions, with government programs supporting the deployment of VSAT systems for educational and healthcare services.

- The rise of 5G technology is creating new opportunities for VSAT providers, as companies look to integrate satellite communications with terrestrial networks to enhance coverage and reliability.

Latin America

- The Brazilian government has initiated the National Broadband Plan, which includes provisions for satellite communications to improve internet access in rural areas, thereby increasing the demand for VSAT solutions.

- Companies like SES and Intelsat are actively working on projects to enhance satellite coverage in Latin America, focusing on providing connectivity for enterprises and remote communities.

North America

- The FCC has recently reorganized its regulations for the licenses for satellite communication. This is expected to facilitate the installation of VSAT in all sectors, especially in the government and the private sector.

- Key players like Hughes Network Systems and Viasat are investing heavily in next-generation satellite technologies, such as high-throughput satellites (HTS), which are enhancing the capacity and efficiency of VSAT services in the region.

Middle East And Africa

- The African Union has launched a strategy to improve the continent's satellite communications, which will boost the use of VSAT in a range of fields, from agriculture to disaster management.

- Regional players like Yahsat and Inmarsat are expanding their services to cater to the growing demand for reliable communication solutions in remote and underserved areas, particularly in the oil and gas sector.

Did You Know?

“Did you know that the first commercial VSAT system was launched in the early 1980s, and since then, the technology has evolved significantly, enabling high-speed internet access even in the most remote locations?” — Satellite Industry Association

Segmental Market Size

Enterprise VSAT is a key part of the satellite communications market, and is experiencing steady growth. The demand for reliable connections in remote locations is mainly driven by the oil and gas, maritime and emergency services industries. Furthermore, the digitalization of the world’s underdeveloped regions is a major driver of this market. Enterprise VSAT is currently in its implementation stage, with several key players, such as Hughes and Viasat, leading the way in North America and Europe. The main applications are high-speed Internet for remote offices, disaster recovery solutions and IoT in agriculture. In the coming years, Enterprise VSAT will be further accelerated by the pandemic of H1N1 and the sustainable development goals in various industries. HTS and ground terminals are enabling the market to evolve, enabling more efficient and cost-effective solutions for enterprises worldwide.

Future Outlook

OVERVIEW OF THE ENTREPRENEURIAL VSAT MARKET IN AFRICA Throughout Africa, the VSAT industry is growing at a fast pace, mainly driven by the increasing demand for reliable and high-speed satellite communications in all industry sectors, such as telecommunications, maritime and remote operations. The need for remote operations and real-time data transmission in underserved and remote areas is further driving the demand for VSAT. Several new technological developments, such as the introduction of high-throughput satellites (HTS) and the integration of software-defined networks (SDN), are set to revolutionize the VSAT industry. These innovations will not only increase the efficiency of satellite capacity, but also reduce latency, thus enabling VSAT to compete more effectively with terrestrial solutions. These developments, combined with government initiatives to increase the availability of broadband services in remote and underserved areas, will create a favourable market environment for VSAT. In the next 10 years, the penetration of VSAT is expected to increase significantly, reaching more than 30 per cent in the key industry sectors.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 6.5 Billion |

| Market Size Value In 2023 | USD 7.10 Billion |

| Growth Rate | 9.24% (2023-2032) |

Enterprise VSAT Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.