Rising Data Volume

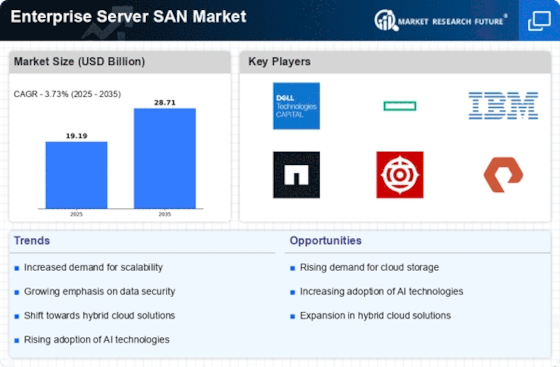

The exponential growth of data generated by enterprises is a primary driver for the Enterprise Server San Market. As organizations increasingly rely on data analytics and storage solutions, the demand for scalable storage systems has surged. According to recent estimates, data creation is projected to reach 175 zettabytes by 2025, necessitating robust storage solutions. This trend compels enterprises to invest in SAN technologies that can efficiently manage and store vast amounts of data. Consequently, the Enterprise Server San Market is witnessing a shift towards high-capacity storage solutions that can accommodate this data influx while ensuring quick access and retrieval. The need for efficient data management systems is likely to continue driving investments in SAN technologies, as organizations seek to optimize their storage capabilities.

Increased Focus on Data Security

The heightened emphasis on data security is a crucial driver for the Enterprise Server San Market. With the rise in cyber threats and data breaches, organizations are prioritizing secure storage solutions to protect sensitive information. The Enterprise Server San Market is projected to reach USD 345.4 billion by 2026, reflecting the growing investment in security measures. SAN solutions are increasingly being designed with advanced security features, such as encryption and access controls, to safeguard data. This trend is likely to propel the demand for SAN technologies that not only provide storage capabilities but also enhance data protection. As enterprises navigate the complexities of data security, the Enterprise Server San Market is expected to evolve, focusing on integrating robust security measures into storage solutions.

Emergence of Hybrid Cloud Solutions

The rise of hybrid cloud solutions is reshaping the landscape of the Enterprise Server San Market. Organizations are increasingly adopting hybrid models that combine on-premises infrastructure with cloud services, allowing for greater flexibility and scalability. This shift necessitates the integration of SAN technologies that can seamlessly connect with cloud environments. The hybrid cloud market is anticipated to grow significantly, with a projected CAGR of around 22% over the next few years. This growth indicates a strong demand for SAN solutions that can facilitate data movement between on-premises and cloud storage. As enterprises seek to leverage the benefits of both environments, the Enterprise Server San Market is likely to see increased investments in SAN technologies that support hybrid cloud architectures.

Demand for High-Performance Computing

The growing demand for high-performance computing (HPC) is a notable driver for the Enterprise Server San Market. As industries such as finance, healthcare, and scientific research require advanced computing capabilities, the need for high-speed data access and processing becomes paramount. HPC environments often rely on SAN solutions to deliver the necessary performance and reliability. The HPC market is projected to reach USD 53.4 billion by 2026, indicating a robust growth trajectory. This demand for HPC is likely to drive investments in SAN technologies that can support the high throughput and low latency required for these applications. As organizations strive to enhance their computational capabilities, the Enterprise Server San Market is expected to adapt, focusing on delivering high-performance storage solutions.

Adoption of Virtualization Technologies

The increasing adoption of virtualization technologies is significantly influencing the Enterprise Server San Market. Virtualization allows multiple virtual machines to run on a single physical server, optimizing resource utilization and reducing costs. As enterprises transition to virtualized environments, the demand for SAN solutions that support these infrastructures is growing. The virtualization market is expected to expand, with a compound annual growth rate of approximately 10% over the next few years. This growth indicates a strong correlation between virtualization adoption and the need for advanced SAN solutions that can provide the necessary performance and scalability. As organizations seek to enhance their IT efficiency, the Enterprise Server San Market is likely to benefit from this trend, as SAN systems become integral to supporting virtualized workloads.