Adoption of 5G Technology

The ongoing rollout of 5G technology is poised to have a transformative impact on the Enterprise Router Market. With its promise of ultra-fast data speeds and low latency, 5G is expected to enable new applications and services that require high-performance networking. As enterprises look to capitalize on the benefits of 5G, there is a growing demand for routers that can support this next-generation technology. Market forecasts indicate that the 5G infrastructure market will reach USD 700 billion by 2026, which will likely drive investments in compatible routers. These routers must be capable of handling increased data loads and providing seamless connectivity across diverse environments. Consequently, the adoption of 5G technology is emerging as a key driver for innovation and growth within the Enterprise Router Market.

Expansion of Cloud Computing Services

The rapid expansion of cloud computing services is significantly influencing the Enterprise Router Market. As businesses increasingly migrate their operations to the cloud, the demand for routers that can efficiently handle cloud-based applications and services is surging. Market data suggests that the cloud services market is expected to reach USD 832 billion by 2025, which in turn drives the need for high-capacity routers capable of managing increased data traffic. These routers must support various cloud architectures, including public, private, and hybrid clouds, ensuring seamless connectivity and performance. Consequently, the integration of cloud capabilities into enterprise routers is becoming a critical factor for organizations seeking to optimize their network infrastructure, thus propelling growth in the Enterprise Router Market.

Rise of Internet of Things (IoT) Devices

The proliferation of Internet of Things (IoT) devices is reshaping the landscape of the Enterprise Router Market. With billions of devices expected to be connected to the internet, the demand for routers that can support a vast number of simultaneous connections is escalating. It is estimated that by 2025, there will be over 75 billion IoT devices globally, necessitating routers that can efficiently manage this influx of data traffic. This trend compels enterprises to invest in routers equipped with advanced features such as enhanced bandwidth management and low-latency capabilities. As organizations seek to leverage IoT technologies for operational efficiency and data analytics, the need for reliable and scalable networking solutions becomes paramount, thereby driving growth in the Enterprise Router Market.

Growing Need for Enhanced Network Security

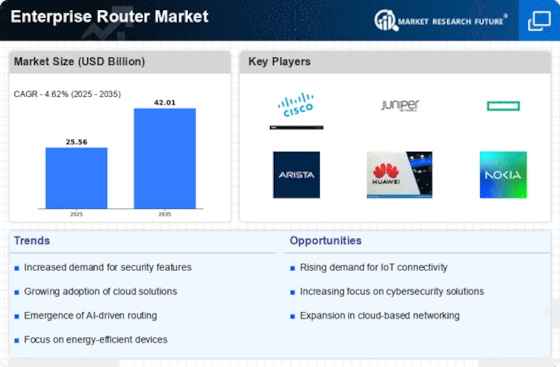

The increasing frequency of cyber threats and data breaches has led to a heightened focus on network security within the Enterprise Router Market. Organizations are investing in advanced routers that offer robust security features, such as firewalls, intrusion detection systems, and encryption capabilities. According to recent data, the demand for secure networking solutions is projected to grow at a compound annual growth rate of 10% over the next five years. This trend indicates that enterprises are prioritizing the protection of sensitive information, thereby driving the adoption of sophisticated routers that can mitigate potential risks. As a result, manufacturers are innovating to provide routers that not only enhance performance but also ensure compliance with stringent security regulations, making security a pivotal driver in the Enterprise Router Market.

Increasing Focus on Network Virtualization

The shift towards network virtualization is significantly influencing the Enterprise Router Market. Organizations are increasingly adopting virtualized network functions to enhance flexibility, scalability, and cost-efficiency. This trend is reflected in the growing demand for routers that support software-defined networking (SDN) and network functions virtualization (NFV). Market analysis indicates that the SDN market is projected to grow at a CAGR of 25% over the next five years, highlighting the urgency for routers that can integrate with these technologies. By enabling dynamic resource allocation and improved network management, virtualized routers are becoming essential for enterprises aiming to optimize their network performance. As such, the increasing focus on network virtualization is driving innovation and investment in the Enterprise Router Market.