Rising Security Concerns

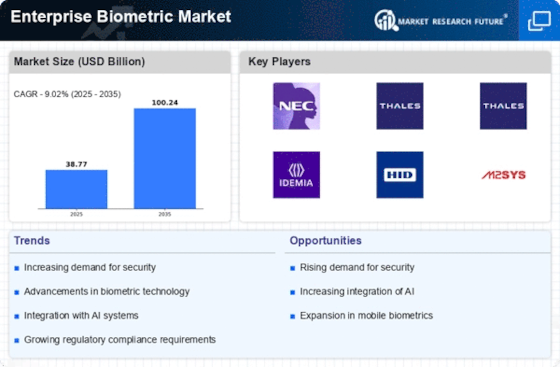

The increasing prevalence of cyber threats and data breaches has heightened the demand for robust security measures across various sectors. Organizations are increasingly recognizing the vulnerabilities associated with traditional authentication methods, which often fall short in providing adequate protection. As a result, the Enterprise Biometric Market is witnessing a surge in the adoption of biometric solutions, which offer enhanced security through unique biological traits. According to recent estimates, the biometric market is projected to grow at a compound annual growth rate of over 20% in the coming years, driven by the need for secure access control and identity verification. This trend indicates a shift towards more sophisticated security frameworks, where biometric technologies are becoming integral to safeguarding sensitive information and assets.

Technological Advancements

Rapid advancements in biometric technologies, such as facial recognition, fingerprint scanning, and iris recognition, are propelling the growth of the Enterprise Biometric Market. Innovations in artificial intelligence and machine learning are enhancing the accuracy and efficiency of biometric systems, making them more appealing to organizations seeking reliable identity verification solutions. The integration of these technologies is not only improving user experience but also reducing operational costs associated with traditional security measures. Market data suggests that the biometric technology segment is expected to witness substantial growth, with facial recognition alone projected to account for a significant share of the market. This evolution in technology is likely to drive further investments in biometric solutions, as businesses strive to stay ahead in an increasingly competitive landscape.

Regulatory Compliance and Standards

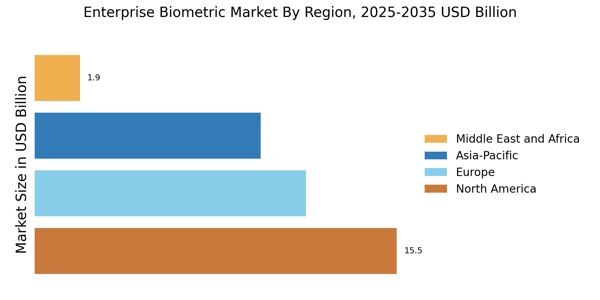

The establishment of stringent regulatory frameworks and compliance standards is significantly influencing the Enterprise Biometric Market. Governments and regulatory bodies are mandating the implementation of secure identification systems to protect sensitive data and ensure privacy. This regulatory push is compelling organizations to adopt biometric solutions as a means of compliance, thereby driving market growth. For instance, regulations such as the General Data Protection Regulation (GDPR) in Europe emphasize the need for secure data handling practices, which include the use of biometric authentication. As organizations strive to meet these compliance requirements, the demand for biometric technologies is expected to rise, creating a favorable environment for market expansion. This trend underscores the importance of aligning biometric solutions with regulatory expectations to enhance trust and security.

Increased Adoption in Financial Services

The financial services sector is increasingly embracing biometric technologies to enhance security and streamline customer experiences. With the rise of digital banking and online transactions, the need for secure authentication methods has become paramount. The Enterprise Biometric Market is witnessing a notable uptick in the adoption of biometric solutions, such as voice recognition and fingerprint scanning, to prevent fraud and identity theft. Market analysis indicates that the financial sector is one of the largest consumers of biometric technologies, with investments expected to grow significantly in the coming years. This trend reflects a broader shift towards integrating biometric authentication into everyday financial operations, thereby improving security and customer trust in digital platforms.

Growing Demand for Seamless User Experience

As organizations strive to enhance customer satisfaction, the demand for seamless user experiences is driving the growth of the Enterprise Biometric Market. Biometric solutions offer a convenient and efficient means of authentication, eliminating the need for passwords and PINs, which can be cumbersome for users. This shift towards user-centric design is particularly evident in sectors such as retail and hospitality, where customer engagement is critical. Market data suggests that businesses implementing biometric technologies are likely to see improved customer retention and loyalty, as these solutions facilitate quicker and more secure transactions. The emphasis on user experience is expected to continue shaping the biometric landscape, encouraging further innovation and adoption across various industries.