Emergence of Agile Methodologies

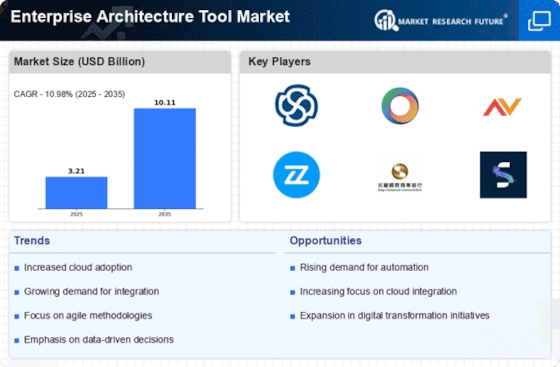

The emergence of agile methodologies is significantly impacting the Enterprise Architecture Tool Market. Organizations are increasingly adopting agile practices to enhance flexibility and responsiveness to market changes. This shift has led to a growing demand for enterprise architecture tools that support agile frameworks, enabling teams to collaborate effectively and iterate rapidly. The market for agile project management tools has seen substantial growth, reflecting the need for solutions that facilitate agile transformations. Enterprise architecture tools that align with agile principles can help organizations streamline processes, improve communication, and foster innovation, thereby reinforcing their competitive advantage in a dynamic business environment.

Growing Importance of Cloud Computing

The growing importance of cloud computing is reshaping the landscape of the Enterprise Architecture Tool Market. As organizations migrate to cloud-based solutions, there is a pressing need for tools that can effectively manage and integrate these environments. The cloud services market has experienced exponential growth, indicating a shift in how businesses operate. Enterprise architecture tools are essential for ensuring that cloud strategies align with overall business objectives, providing frameworks that facilitate seamless integration and management of cloud resources. This trend highlights the necessity for organizations to adopt enterprise architecture tools that can support their cloud initiatives and drive digital transformation.

Rising Demand for Digital Transformation

The increasing demand for digital transformation across various sectors appears to be a primary driver for the Enterprise Architecture Tool Market. Organizations are striving to enhance operational efficiency and customer engagement through digital initiatives. According to recent data, the market for digital transformation technologies is projected to reach substantial figures, indicating a robust growth trajectory. This trend necessitates the adoption of enterprise architecture tools that facilitate the alignment of IT infrastructure with business goals. As companies seek to streamline processes and improve agility, the role of enterprise architecture tools becomes increasingly critical in ensuring that technology investments yield optimal returns.

Regulatory Compliance and Risk Management

Regulatory compliance and risk management are becoming increasingly pivotal in the Enterprise Architecture Tool Market. Organizations are compelled to adhere to stringent regulations, which necessitate the implementation of robust governance frameworks. The market for compliance management solutions has seen notable growth, reflecting the heightened focus on risk mitigation strategies. Enterprise architecture tools play a vital role in helping organizations navigate complex regulatory landscapes by providing frameworks that ensure compliance while optimizing business processes. This alignment not only reduces the risk of penalties but also enhances overall operational resilience, making these tools indispensable in today's regulatory environment.

Increased Focus on Data-Driven Decision Making

The shift towards data-driven decision making is significantly influencing the Enterprise Architecture Tool Market. Organizations are increasingly recognizing the value of data analytics in shaping strategic initiatives. The market for business intelligence and analytics tools has expanded, suggesting a growing appetite for solutions that enable informed decision making. Enterprise architecture tools facilitate the integration of data across various systems, ensuring that stakeholders have access to accurate and timely information. This capability is essential for organizations aiming to leverage data insights to drive innovation and improve competitive positioning, thereby underscoring the importance of these tools in contemporary business practices.