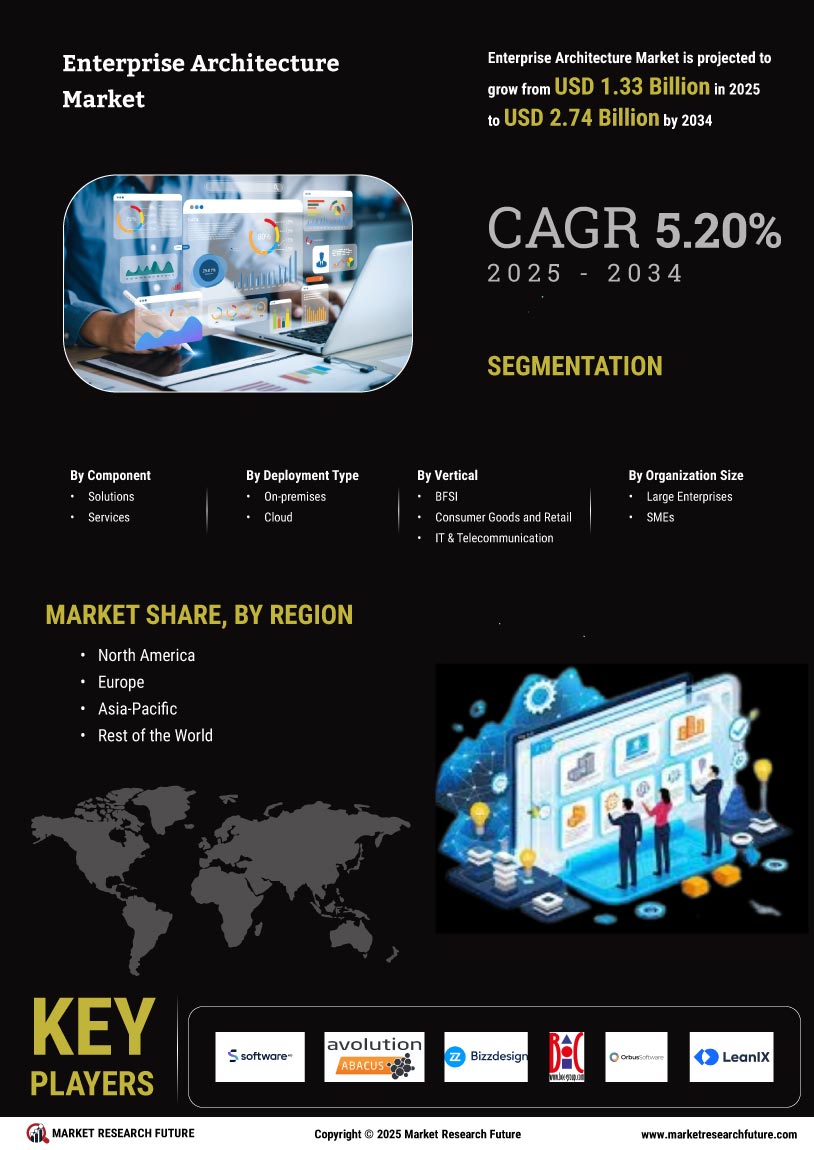

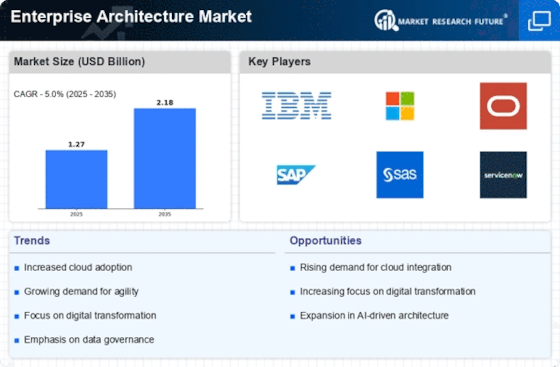

Focus on Digital Transformation

The ongoing focus on digital transformation is reshaping the Enterprise Architecture Market. Organizations are increasingly recognizing the necessity of evolving their business models to remain relevant in a rapidly changing environment. This transformation often necessitates a comprehensive overhaul of existing enterprise architectures to support new digital initiatives. Data indicates that companies investing in digital transformation are expected to achieve a 20 to 30% increase in operational efficiency. Consequently, the demand for enterprise architecture frameworks that facilitate this transformation is surging. As businesses strive to enhance customer experiences and streamline operations, the Enterprise Architecture Market is poised for substantial growth, driven by the need for adaptable and scalable architectural solutions.

Holistic Architectural Approaches

The adoption of holistic architectural approaches is becoming a defining characteristic of the Enterprise Architecture Market. Organizations are increasingly moving away from siloed architectures towards integrated frameworks that encompass all aspects of their operations. This shift is driven by the need for improved collaboration and communication across departments, which is essential for achieving strategic objectives. Research suggests that organizations employing holistic approaches can reduce operational costs by up to 25%. As businesses recognize the value of interconnected systems and processes, the demand for enterprise architecture solutions that support these holistic frameworks is likely to increase. This trend indicates a significant opportunity for growth within the Enterprise Architecture Market as organizations seek to optimize their overall performance.

Increased Focus on Data Governance

The increased focus on data governance is emerging as a significant driver in the Enterprise Architecture Market. Organizations are recognizing the importance of managing data effectively to ensure accuracy, security, and compliance. As data becomes a critical asset, the need for enterprise architecture frameworks that support robust data governance practices is becoming more pronounced. Research indicates that organizations with strong data governance frameworks can achieve a 30% improvement in data quality. This trend suggests that businesses are prioritizing the establishment of comprehensive data governance strategies within their enterprise architectures. Consequently, the demand for solutions that facilitate effective data management and governance is likely to rise, presenting a notable opportunity for growth within the Enterprise Architecture Market.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence, machine learning, and cloud computing is a pivotal driver in the Enterprise Architecture Market. Organizations are increasingly adopting these technologies to enhance operational efficiency and improve decision-making processes. According to recent data, the market for cloud computing is projected to reach USD 832.1 billion by 2025, indicating a robust demand for enterprise architecture solutions that can seamlessly integrate with these technologies. This trend suggests that businesses are prioritizing the alignment of their IT infrastructure with innovative technologies, thereby fostering agility and responsiveness in their operations. As a result, the Enterprise Architecture Market is likely to witness significant growth as organizations seek to leverage these advancements to stay competitive.

Regulatory Compliance and Risk Management

Regulatory compliance and risk management are critical drivers in the Enterprise Architecture Market. As organizations face increasing scrutiny from regulatory bodies, the need for robust enterprise architecture frameworks that ensure compliance with various regulations is paramount. Data shows that companies investing in compliance-related technologies can reduce the risk of regulatory fines by up to 40%. This trend underscores the importance of integrating compliance considerations into enterprise architecture strategies. Furthermore, as organizations navigate complex regulatory landscapes, the demand for enterprise architecture solutions that facilitate risk management and compliance is likely to grow. This focus on regulatory adherence presents a substantial opportunity for the Enterprise Architecture Market to expand its offerings and support organizations in mitigating risks.