Market Share

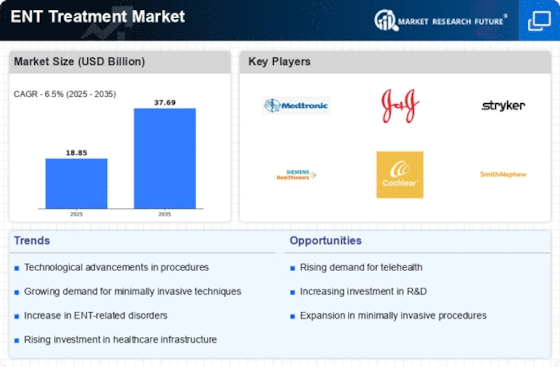

ENT Treatment Market Share Analysis

With an end goal to hold onto piece of the pie, medical services associations are centred around the ENT Therapy market deliberately. Recognizing the intricacy of ENT problems, various helpful methodologies are contrived, including surgeries, drug cures, and arising demonstrative innovations. This technique ensures designated market section, situating organizations as leaders in conveying further developed ENT treatment choices. The customization of ENT treatment results is basic in the business, as organizations endeavour to make medicines that are custom-made to the special clinical states of every patient. These incorporate high level hear-able help gadgets, negligibly obtrusive sinus methods, and individualized medicines for problems of the vocal rope. Security and viability of ENT medicines are basic for market situating. To work on understanding security, results, and accuracy, organizations allot assets toward exploration, improvement, and administrative consistence. Firms improve their market situating through interests in state-of-the-art ENT treatment advances, like 3D imaging, laser treatments, and implantable hearing gadgets, which draw in trained professionals and lay out them as pioneers. Laying out essential partnerships with ENT subject matter experts, clinical foundations, and exploration associations effectively advances market situating, guarantee that treatment arrangements stay current with the changing requests of medical care, smooth out clinical preliminaries, and add to the improvement of proof based rehearses. The execution of instructive projects focused on medical services experts and patients is of vital significance to progress ENT therapy advancements into clinical practices and work on quiet consideration while at the same time expanding mindfulness. Worldwide development is basic for organizations working in the ENT treatment area to actually take special care of local medical services requests and social tendencies. By represent considerable authority in these areas, organizations increment their piece of the pie and set up a good foundation for themselves as pioneers in the overall ENT treatment industry. Assessing and imparting the results of ear, nose, and throat (ENT) mediations are basic parts of publicizing efforts. Clinical preliminaries, genuine results, and patient achievement stories are utilized by organizations to highlight the unwavering quality and viability of their medicines for different ENT issues. Cultivating open and straightforward exchange with respect to the wellbeing and adequacy of option ENT medicines empowers medical services suppliers and patients to foster certainty and trust.

Leave a Comment