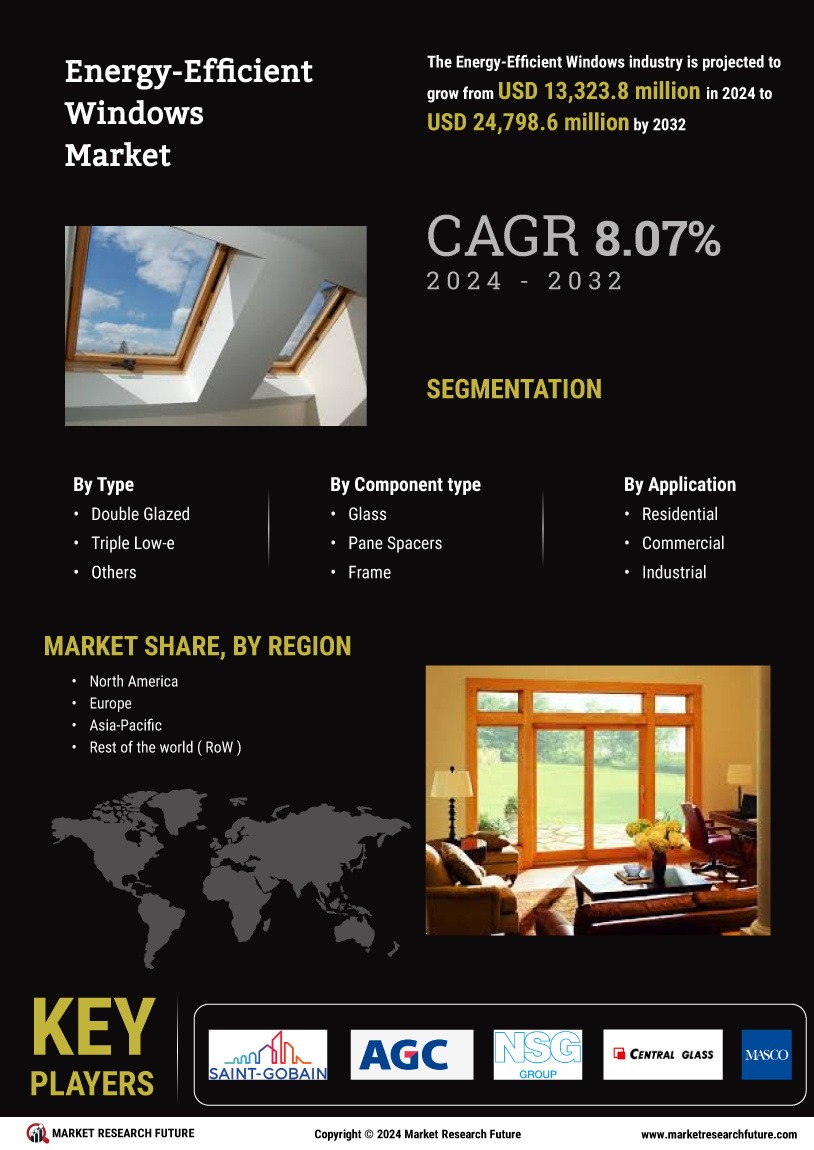

Market Growth Projections

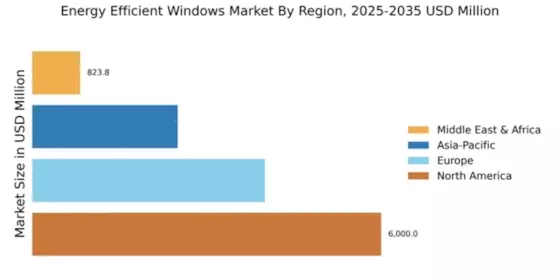

The Global Energy-Efficient Windows Market Industry is projected to experience substantial growth in the coming years. With a market value anticipated to reach 13.3 USD Billion in 2024 and further expand to 31.3 USD Billion by 2035, the industry is poised for a robust trajectory. The compound annual growth rate (CAGR) of 8.07% from 2025 to 2035 indicates a strong demand for energy-efficient solutions, driven by regulatory changes, consumer preferences, and technological advancements. This growth reflects a broader commitment to sustainability and energy conservation in the global construction landscape.

Growing Construction Sector

The expansion of the construction sector globally is a pivotal driver for the Global Energy-Efficient Windows Market Industry. As urbanization accelerates and new residential and commercial projects emerge, the demand for energy-efficient windows is likely to increase. Builders and architects are increasingly incorporating energy-efficient designs into their projects to meet regulatory standards and consumer preferences. This trend is expected to sustain the market's growth, particularly as the construction industry adapts to evolving energy efficiency norms and seeks to enhance the sustainability of new developments.

Increased Consumer Awareness

Consumer awareness regarding energy efficiency and environmental sustainability is a significant driver for the Global Energy-Efficient Windows Market Industry. As individuals become more informed about the benefits of energy-efficient windows, including reduced energy bills and improved indoor comfort, demand is likely to rise. Educational campaigns and initiatives by environmental organizations further enhance this awareness. This shift in consumer preferences is expected to contribute to the market's growth, with projections indicating a rise to 31.3 USD Billion by 2035, highlighting the increasing importance of energy-efficient solutions in residential and commercial buildings.

Government Incentives and Subsidies

Government incentives and subsidies play a crucial role in driving the Global Energy-Efficient Windows Market Industry. Various countries offer financial incentives to homeowners and businesses that invest in energy-efficient upgrades, including windows. These programs aim to stimulate the market by reducing the initial costs associated with purchasing and installing energy-efficient windows. For example, tax credits and rebates can significantly lower the financial burden on consumers, encouraging them to opt for energy-efficient solutions. This supportive policy environment is expected to contribute to the market's growth trajectory in the coming years.

Rising Energy Efficiency Regulations

The Global Energy-Efficient Windows Market Industry is experiencing growth due to stringent energy efficiency regulations imposed by governments worldwide. These regulations aim to reduce energy consumption in buildings, thereby promoting the adoption of energy-efficient windows. For instance, the implementation of the Energy Star program in various countries encourages manufacturers to produce windows that meet specific energy performance criteria. As a result, the market is projected to reach 13.3 USD Billion in 2024, reflecting a growing emphasis on energy conservation and sustainability in the construction sector.

Technological Advancements in Window Manufacturing

Technological advancements in window manufacturing processes are propelling the Global Energy-Efficient Windows Market Industry forward. Innovations such as low-emissivity (Low-E) coatings, triple glazing, and advanced frame materials enhance the thermal performance of windows. These technologies not only improve energy efficiency but also offer better durability and aesthetics. As manufacturers adopt these cutting-edge technologies, the market is likely to witness a compound annual growth rate (CAGR) of 8.07% from 2025 to 2035, indicating a robust future for energy-efficient window solutions.