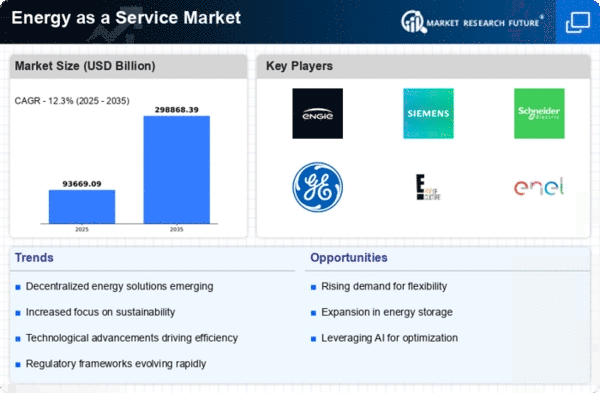

Market Share

Energy as a Service Market Share Analysis

In the competitive landscape of the Energy as a Service (EaaS) market, effective market share positioning strategies play a pivotal role in determining the success and prominence of service providers. A well-known method uses unique services to stand out. EaaS companies work hard to stand out by providing a lot of services that go beyond normal energy supply. People who offer complete solutions like advice on using energy well, putting clean power sources in use and high-level data work. They set themselves as all-round helpers for companies looking to manage their total energy needs easily.

This difference lets sellers get more of the market by meeting different and changing customer wants. Also, concentrating on being green and taking care of the environment is a strong plan for winning customers in the EaaS market. Businesses that want to be green are looking for sellers who focus on reducing carbon, using energy from the sun and doing good things with money. These help companies reach goals they have set up around being environmentally friendly. Providing EaaS services that help reduce pollution, save energy and use green power resources makes the company partners in their clients' larger eco-friendly projects.

This attracts businesses who care about saving the environment. Investment ways are important for where you stand in the market of Services as a Product. People who give out loans that can be changed, like deals based on doing well or saving energy power agreements make it easier for more businesses to use their services. This money freedom deals with the capital limits often connected to green energy investments.

It opens up chances for EaaS suppliers to grab a bigger part of the market by fitting different kinds of financial choices and restrictions. Additionally, taking action to follow the rules is a smart way of arranging your place in the market. EaaS providers who understand hard rules and know about changing energy laws put themselves as partners you can trust for businesses looking to follow green regulations. They also take use of offers that help them be kinder on the environment. By following the rules and being honest, providers can gain more trust. This helps businesses make better choices and get a big share of the market

Leave a Comment