Rising Cybersecurity Threats

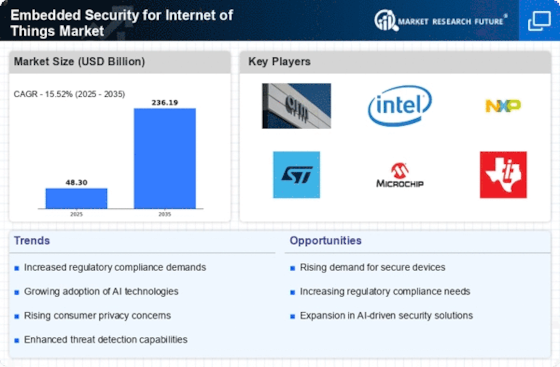

The Embedded Security for Internet of Things Market is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. As more devices connect to the internet, the attack surface expands, making IoT devices attractive targets for malicious actors. Reports indicate that the number of cyberattacks on IoT devices has risen significantly, prompting organizations to prioritize embedded security solutions. This trend is likely to drive investments in advanced security measures, as businesses seek to protect sensitive data and maintain consumer trust. The need for robust security frameworks is becoming paramount, as vulnerabilities in IoT devices can lead to severe financial and reputational damage. Consequently, the Embedded Security for Internet of Things Market is poised for growth as companies strive to mitigate these risks.

Growing Adoption of Smart Devices

The Embedded Security for Internet of Things Market is witnessing accelerated growth due to the widespread adoption of smart devices across various sectors. The proliferation of smart home technologies, wearables, and industrial IoT applications has created a pressing need for enhanced security measures. Market data indicates that the number of connected devices is expected to reach billions in the coming years, further emphasizing the necessity for embedded security solutions. As consumers and businesses increasingly rely on these devices for daily operations, the potential risks associated with inadequate security become more pronounced. Consequently, manufacturers are compelled to prioritize embedded security in their product designs, driving innovation and investment in the Embedded Security for Internet of Things Market. This trend highlights the critical role of security in the successful deployment of smart technologies.

Regulatory Compliance Requirements

The Embedded Security for Internet of Things Market is influenced by stringent regulatory frameworks aimed at enhancing data protection and privacy. Governments and regulatory bodies are increasingly implementing laws that mandate security measures for IoT devices, compelling manufacturers to integrate embedded security features. For instance, regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose strict guidelines on data handling and security practices. Compliance with these regulations is not only essential for legal adherence but also for maintaining consumer confidence. As a result, organizations are investing in embedded security solutions to ensure compliance, thereby driving growth in the Embedded Security for Internet of Things Market. This trend suggests a proactive approach to security, as businesses recognize the importance of safeguarding user data.

Increased Investment in IoT Security Solutions

The Embedded Security for Internet of Things Market is benefiting from a notable increase in investment directed towards IoT security solutions. Organizations are recognizing the importance of safeguarding their IoT ecosystems against potential threats, leading to a surge in funding for security startups and technology development. Recent data suggests that venture capital investments in IoT security have seen substantial growth, reflecting a heightened awareness of security challenges. This influx of capital is likely to foster innovation, resulting in the development of advanced embedded security technologies tailored for IoT applications. As businesses seek to enhance their security posture, the Embedded Security for Internet of Things Market is expected to expand, driven by the demand for cutting-edge solutions that address emerging threats.

Consumer Awareness and Demand for Security Features

The Embedded Security for Internet of Things Market is increasingly shaped by consumer awareness regarding security issues associated with IoT devices. As incidents of data breaches and privacy violations become more prevalent, consumers are becoming more discerning about the security features of the devices they purchase. This heightened awareness is prompting manufacturers to prioritize embedded security in their product offerings, as consumers demand transparency and robust security measures. Market trends indicate that consumers are willing to pay a premium for devices that offer enhanced security features, thereby influencing product development strategies. This shift in consumer behavior is likely to drive growth in the Embedded Security for Internet of Things Market, as companies strive to meet the evolving expectations of security-conscious consumers.