Market Trends

Key Emerging Trends in the Embedded Analytics Market

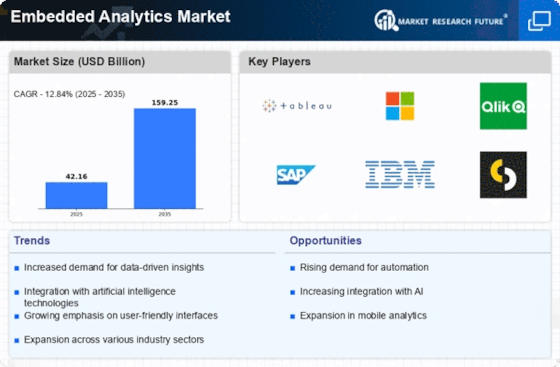

The embedded analytics market has been encountering huge patterns that are molding its scene and impacting organizations across different enterprises. Embedded analytics alludes to the mix of business knowledge (BI) and analytics abilities straightforwardly into programming applications, giving clients continuous experiences and information driven dynamic inside their work process. One conspicuous pattern in the market is the rising interest for noteworthy experiences and information driven dynamic across various areas. Associations are perceiving the significance of utilizing analytics flawlessly inside their current applications to upgrade functional productivity and remain cutthroat in the present information driven business climate.

One more essential pattern is the developing reception of cloud-based embedded analytics arrangements. Cloud innovation offers versatility, adaptability, and openness, making it more straightforward for organizations to send and oversee embedded analytics apparatuses. This shift towards cloud-based arrangements lines up with the more extensive pattern of associations relocating their applications and information to the cloud, empowering them to outfit the force of analytics without the requirement for broad on-premises foundation.

Moreover, there is an observable ascent in the utilization of man-made consciousness (simulated intelligence) and AI (ML) in embedded analytics. These cutting edge innovations improve the prescient and prescriptive analytics abilities of embedded arrangements, giving clients more exact experiences and suggestions. As organizations endeavor to figure out huge measures of information, computer based intelligence and ML-controlled embedded analytics assume an essential part in robotizing complex logical undertakings, uncovering designs, and conveying noteworthy knowledge.

The market is additionally seeing an expanded spotlight on client experience and self-administration analytics. Organizations are searching for embedded analytics arrangements that are easy to use, instinctive, and enable non-specialized clients to autonomously investigate and dissect information. This pattern is driven by the need to democratize information access and engage a more extensive scope of workers to go with information driven choices, lessening reliance on particular information investigators.

Additionally, the interest for continuous analytics is driving advancement in the embedded analytics market. Associations are looking for arrangements that can give moment bits of knowledge and backing continuous navigation. This is especially urgent in ventures like money, medical services, and assembling, where convenient choices can essentially affect business results.

As far as industry-explicit patterns, the medical services area is progressively embracing embedded analytics to work on persistent consideration, advance tasks, and upgrade generally productivity. Additionally, the monetary administrations industry is utilizing embedded analytics to acquire bits of knowledge into client conduct, oversee risk all the more really, and follow administrative necessities.

As the worldwide embedded analytics market keeps on developing, merchants are zeroing in on essential organizations and joint efforts to grow their market presence. This pattern is driven by the acknowledgment that coordinating analytics consistently into existing applications requires a cooperative methodology. Sellers are cooperating with programming designers, stage suppliers, and industry-explicit specialists to make far reaching embedded analytics arrangements that address the remarkable requirements of various areas.

Leave a Comment