Market Trends and Projections

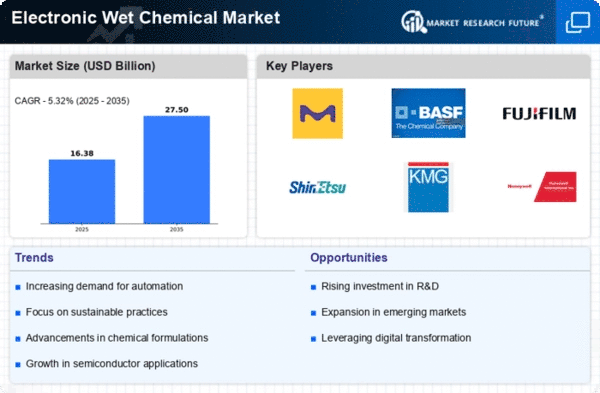

The Global Electronic Wet Chemical Market Industry is characterized by dynamic trends and projections that reflect its growth potential. The market is anticipated to reach a valuation of 15.6 USD Billion in 2024, with expectations of expanding to 27.6 USD Billion by 2035. The compound annual growth rate of 5.34% from 2025 to 2035 indicates a robust trajectory, driven by factors such as technological advancements, increased semiconductor demand, and the growth of renewable energy. These trends highlight the industry's resilience and adaptability in a competitive landscape, positioning it for sustained growth in the coming years.

Rising Demand for Semiconductors

The Global Electronic Wet Chemical Market Industry experiences a surge in demand for semiconductors, driven by the proliferation of electronic devices and the advancement of technologies such as 5G and IoT. As semiconductor manufacturing processes become increasingly complex, the need for high-purity chemicals, essential for etching and cleaning, intensifies. This trend is reflected in the projected market size of 15.6 USD Billion in 2024, indicating a robust growth trajectory. The semiconductor sector's expansion is likely to propel the demand for electronic wet chemicals, thereby solidifying their critical role in the manufacturing ecosystem.

Growth of Renewable Energy Sector

The Global Electronic Wet Chemical Market Industry is poised to benefit from the growth of the renewable energy sector, particularly in the production of solar panels and batteries. As the world transitions towards sustainable energy solutions, the demand for high-purity chemicals used in photovoltaic cell manufacturing and battery production is likely to increase. This trend aligns with global efforts to reduce carbon emissions and promote clean energy technologies. The market's expansion is anticipated to reach 27.6 USD Billion by 2035, underscoring the pivotal role of electronic wet chemicals in supporting the renewable energy infrastructure.

Increased Focus on Research and Development

Investment in research and development within the Global Electronic Wet Chemical Market Industry is critical for fostering innovation and enhancing product offerings. Companies are increasingly allocating resources to develop new chemical formulations that meet the evolving needs of the electronics sector. This focus on R&D not only drives product differentiation but also enables manufacturers to stay competitive in a rapidly changing market landscape. As a result, the industry is likely to witness a steady influx of innovative solutions that cater to diverse applications, further propelling market growth and establishing a foundation for future advancements.

Regulatory Compliance and Environmental Standards

The Global Electronic Wet Chemical Market Industry faces increasing pressure to comply with stringent regulatory and environmental standards. Governments worldwide are implementing regulations aimed at reducing hazardous waste and promoting sustainable practices in chemical manufacturing. This regulatory landscape compels manufacturers to invest in cleaner production methods and eco-friendly chemical alternatives. Compliance not only mitigates risks associated with environmental liabilities but also enhances brand reputation among consumers. As the industry adapts to these regulations, the demand for compliant electronic wet chemicals is expected to rise, contributing to the overall market growth.

Technological Advancements in Manufacturing Processes

Technological innovations in manufacturing processes significantly influence the Global Electronic Wet Chemical Market Industry. The introduction of advanced chemical formulations and automated systems enhances efficiency and reduces waste, aligning with sustainability goals. For instance, the adoption of eco-friendly chemicals is gaining traction, as manufacturers seek to minimize environmental impact while maintaining product quality. This shift not only caters to regulatory requirements but also appeals to environmentally conscious consumers. As a result, the market is expected to witness a compound annual growth rate of 5.34% from 2025 to 2035, reflecting the industry's adaptability to evolving technological landscapes.