North America : Market Leader in Innovation

North America is poised to maintain its leadership in the Electrical Wiring and Panel Inspection Services Market, holding a significant market share of 2.75 billion. The region's growth is driven by stringent safety regulations, increasing demand for energy-efficient solutions, and advancements in technology. The push for smart grid initiatives and renewable energy integration further catalyzes market expansion, ensuring compliance with evolving standards.

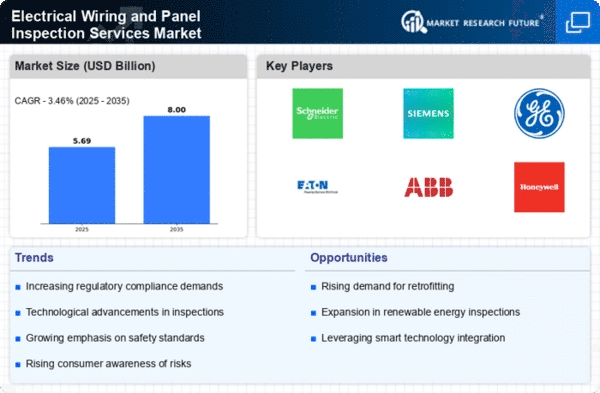

The competitive landscape is robust, with key players like General Electric, Siemens, and Eaton leading the charge. The U.S. and Canada are the primary markets, benefiting from substantial investments in infrastructure and modernization projects. The presence of established companies fosters innovation and enhances service delivery, positioning North America as a hub for electrical services.

Europe : Regulatory Framework Driving Growth

Europe's Electrical Wiring and Panel Inspection Services Market is valued at 1.5 billion, driven by rigorous regulatory frameworks and a growing emphasis on safety standards. The European Union's directives on electrical safety and energy efficiency are pivotal in shaping market dynamics. The increasing adoption of smart technologies and sustainable practices further fuels demand, as businesses seek to comply with regulations while enhancing operational efficiency.

Leading countries such as Germany, France, and the UK dominate the market, with significant contributions from companies like Schneider Electric and ABB. The competitive landscape is characterized by a mix of established firms and emerging players, all vying for market share. The focus on innovation and compliance ensures a dynamic environment, fostering growth and investment in electrical services.

Asia-Pacific : Emerging Market with Potential

The Asia-Pacific region, with a market size of 1.2 billion, is witnessing rapid growth in the Electrical Wiring and Panel Inspection Services Market. This growth is fueled by urbanization, industrialization, and increasing investments in infrastructure. Countries like China and India are at the forefront, driven by government initiatives aimed at enhancing electrical safety and efficiency. The rising demand for renewable energy sources also plays a crucial role in shaping market trends.

The competitive landscape is evolving, with both local and international players, including Honeywell and Emerson Electric, expanding their presence. The region's diverse market dynamics present opportunities for innovation and collaboration. As regulatory frameworks become more stringent, the demand for inspection services is expected to rise, further propelling market growth.

Middle East and Africa : Nascent Market with Challenges

The Middle East and Africa region represents a nascent market for Electrical Wiring and Panel Inspection Services, valued at just 0.05 billion. The growth is hindered by economic challenges, limited infrastructure development, and varying regulatory standards across countries. However, there is a growing awareness of the importance of electrical safety and compliance, which could drive future demand. The region's focus on diversifying economies and investing in infrastructure may also create opportunities for market expansion.

Countries like South Africa and the UAE are leading the way, but the competitive landscape remains fragmented. Key players are beginning to establish a foothold, but the market is still in its infancy. As awareness and regulatory frameworks improve, the potential for growth in electrical services will likely increase, attracting investment and innovation.