Electrical Wiring Interconnection System Market

Introduction

The research methodology is the core of every market authoritative analysis. Thus, the research methodology utilized for this market analysis on the worldwide electrical wiring interconnection system market is strongly based on primary and secondary sources. Primary research typically involves direct communication with participants by way of surveys and interviews, while secondary research mainly comprises derived information from published resources, like trade journals, governmental websites, paid databases, and similar sources.

The primary research method was adopted to validate the information collected through secondary research to acquire complete and correct market figures. A top-to-bottom approach was connected in primary & secondary research.

Objectives of the Study

This market report is an evaluation of the Electrical Wiring Interconnection System Market and provides important insight into this market. This report aids its readers in recognizing opportunities, threats, drivers and restraints within the market and understanding future workforce needs. This report contains thorough data on the market size (in terms of value & volume), share, area of application, major competitors, trends & their impact in the long-term, and forecast analysis. It involves both supply and demand-side data triangulation techniques to help better assimilate accurate numbers with vital insights.

Scope of the Study

The Electrical Wiring Interconnection System Market analysis is conducted over the forecast period of 2023-2030. The report strives to provide the latest market insights & enhance prospective opportunities in the market. As of now, it endures an estimation of the global market concerning the factors boosting or restraining the market growth. Additionally, it provides true figures and estimations of the market about the segments and sub-segments. The region-wise analysis illuminates the geographic significance of the Electrical Wiring Interconnection System Market. The historic analysis aspect also makes up for in-depth knowledge about prominent & emerging industry trends from 2023 - 2030.

Research Type

The research type is a mixed method research.

Research Design

The research design for this market analysis was descriptive in nature. The research design involves understanding different aspects of the Electrical Wiring Interconnection System Market so that it can be analyzed from various angles and create a comprehensive picture of the market.

Sample Size

The sample size for the study was 1000, comprising individuals from companies who manufacture electrical wiring interconnection systems, various stakeholders and decision-makers from end-user industries, individuals from research firms and experts in the field of electrical wiring interconnection systems.

Data Collection Methods

In this report, both primary and secondary research techniques have been utilized. Primary research included conducting telephonic and In-depth Interviews with key industry experts such as manufacturers, suppliers, distributors, and end-users, while secondary research involved the analysis of information from many sources such as company reports, literature, government databases, annual reports, financials, journals, magazines, press releases and the internet.

Data Sources

The data collected for the analysis and compilation of this report has been obtained from both primary and secondary sources. Secondary data includes data from paid databases, press releases and industry journals, while primary data has been collected through interviews and surveys. These primary sources include industry experts, research analysts and executives from the industry.

Research Method

The research methodology used to collect, analyze and interpret market data was based on market appropriate and factor analysis. The factor analysis involved dividing the total sample into at least two parts, the information for which was available from both primary and secondary sources.

Data Triangulation

To arrive at market size estimations the data triangulation method adopted in this study involves demand-side and supply-side data triangulation. The demand-side data triangulation involved a bottom-up analysis, while the supply-side data triangulation involved a top-down approach.

Time-Series Analysis

Time-series analysis was used to facilitate trends and variations in the industry. Moreover, a time frame of 2023-2030 was taken into account to calculate the growth rate of the industry.

Analytical Tools Applied

Analysis of the Electrical Wiring Interconnection System Market involves the utilization of numerous analytical tools such as market attractive analysis, Porter’s five forces model, market risk analyses, market segmentation and market maturity analyses. It assists in validating the data collected through extensive research. Market attractiveness analysis offers an in-depth vision of the competitive landscape of the industry and its main segments. Porter’s Five Forces model assists in understanding the functioning of the various forces that influence the market.

Evaluation of International and Regional Markets

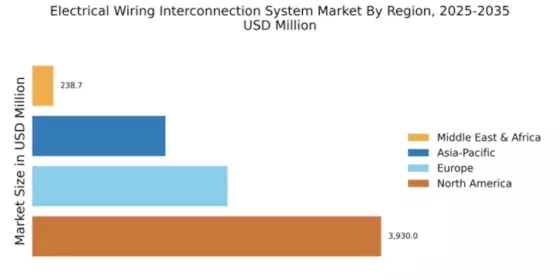

The global market for Electrical Wiring Interconnection Systems has been categorized into different regions such as Europe, North America, Asia-Pacific, and the Middle East & Africa. The market analysis of each region has been conducted to understand the key players, potential markets, and current trends in these regions. Moreover, regional trends and need estimations are also included in the study.

Data Analysis

The data gathered by the top-down and bottom-up approaches is organized, analyzed and interpreted using a variety of statistical, analytical and key performance indicators with qualitative & quantitative primary & secondary market research processes.