Growth in Renewable Energy Sector

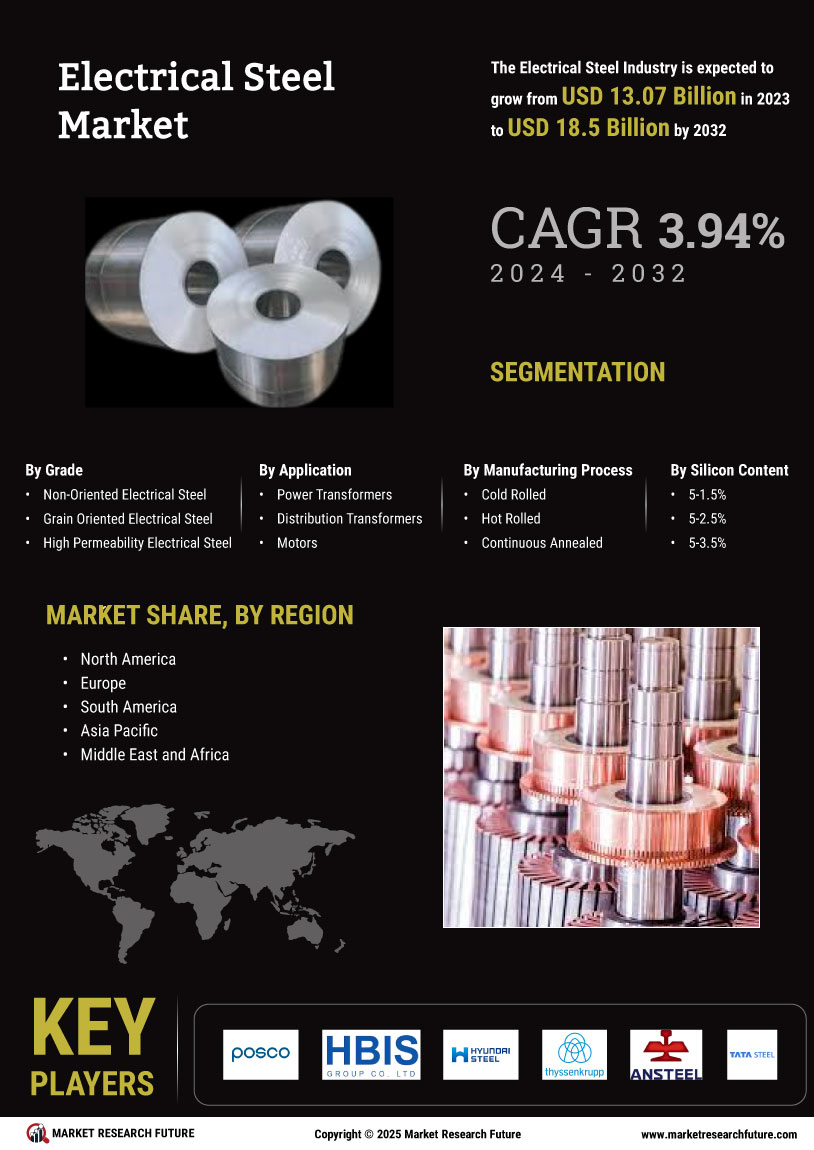

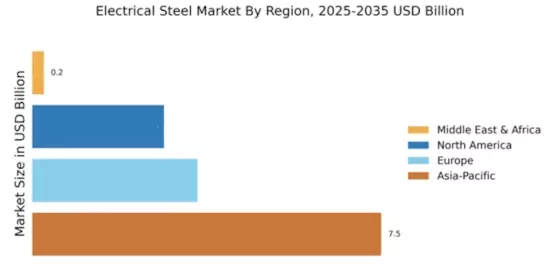

The expansion of the renewable energy sector, particularly wind and solar power, is poised to drive the Global Electrical Steel Market Industry. Electrical steel is essential in the production of transformers and generators used in renewable energy applications. As countries worldwide commit to reducing carbon emissions and increasing renewable energy capacity, the demand for electrical steel is likely to grow. This trend may lead to a market valuation of approximately 21.6 USD Billion by 2035, reflecting a robust compound annual growth rate (CAGR) of 3.94% from 2025 to 2035, as investments in green technologies escalate.

Rising Demand for Electric Vehicles

The increasing adoption of electric vehicles (EVs) is a primary driver for the Global Electrical Steel Market Industry. As automakers transition towards electrification, the demand for high-performance electrical steel, which enhances the efficiency of electric motors, is expected to surge. This shift is anticipated to contribute significantly to the market, with projections indicating that the Global Electrical Steel Market could reach 14.1 USD Billion in 2024. The integration of advanced electrical steel in EV manufacturing not only improves energy efficiency but also reduces overall vehicle weight, thereby enhancing performance and sustainability.

Increased Focus on Energy Efficiency

The growing emphasis on energy efficiency in industrial applications is a significant driver for the Global Electrical Steel Industry. Industries are increasingly adopting technologies that minimize energy consumption and enhance operational efficiency. Electrical steel, known for its superior magnetic properties, is integral to achieving these goals in various applications, including motors and transformers. As energy regulations become more stringent, the demand for high-quality electrical steel is expected to rise. This trend may contribute to a market valuation of 21.6 USD Billion by 2035, reflecting the industry's commitment to sustainability and efficiency.

Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development across the globe are contributing to the demand for electrical steel. As cities expand, the need for efficient electrical grids and power distribution systems becomes paramount. Electrical steel plays a crucial role in transformers and other electrical equipment essential for modern infrastructure. This trend is expected to bolster the Global Electrical Steel Market Industry, with estimates suggesting a market value of 14.1 USD Billion in 2024. The ongoing investments in urban infrastructure are likely to sustain this demand, further enhancing the market's growth trajectory.

Technological Advancements in Electrical Steel Production

Innovations in the manufacturing processes of electrical steel are significantly influencing the Global Electrical Steel Market Industry. Enhanced production techniques, such as the development of high-grade silicon steel, improve magnetic properties and reduce energy losses in electrical applications. These advancements not only lead to better performance but also lower production costs, making electrical steel more accessible to various industries. As a result, the market is likely to experience sustained growth, with projections indicating a potential increase in market size to 21.6 USD Billion by 2035, driven by these technological improvements.