Expansion of Charging Infrastructure

The expansion of charging infrastructure is a vital factor influencing the Electric Vehicle Transmission Market. As more charging stations become available, the practicality of owning electric vehicles increases, encouraging more consumers to make the switch from traditional vehicles. In 2025, the number of public charging stations is projected to grow significantly, enhancing the overall appeal of electric vehicles. This development not only supports the adoption of electric vehicles but also necessitates the advancement of transmission technologies that can optimize energy consumption during charging. Consequently, the growth of charging infrastructure is expected to have a positive impact on the Electric Vehicle Transmission Market.

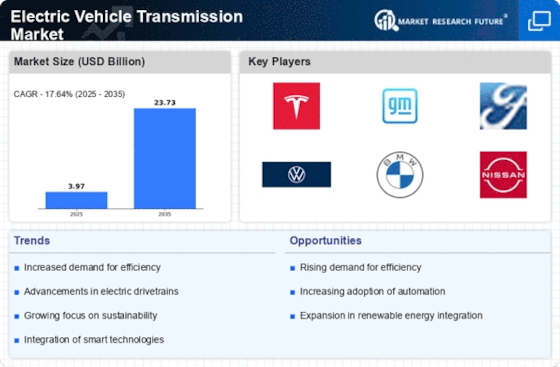

Growing Demand for Electric Vehicles

The increasing consumer preference for electric vehicles (EVs) is a primary driver of the Electric Vehicle Transmission Market. As environmental concerns rise, more individuals and businesses are opting for EVs over traditional combustion engine vehicles. In 2025, the sales of electric vehicles are projected to reach approximately 10 million units, indicating a substantial growth trajectory. This surge in demand necessitates advanced transmission systems that can efficiently manage the unique power delivery requirements of electric drivetrains. Consequently, manufacturers are focusing on developing innovative transmission solutions tailored for electric vehicles, thereby propelling the Electric Vehicle Transmission Market forward.

Government Incentives and Regulations

Government policies and incentives aimed at promoting electric vehicle adoption significantly influence the Electric Vehicle Transmission Market. Many countries have implemented stringent emissions regulations and offer financial incentives for EV purchases, which encourage consumers to transition from fossil fuel vehicles. For instance, tax credits, rebates, and grants are common strategies employed to stimulate market growth. As of 2025, numerous regions are expected to enhance their regulatory frameworks, further supporting the shift towards electric mobility. This regulatory environment creates a favorable landscape for the development and deployment of advanced transmission technologies, thereby driving the Electric Vehicle Transmission Market.

Rising Awareness of Environmental Impact

The growing awareness of the environmental impact of transportation fuels is a significant driver for the Electric Vehicle Transmission Market. Consumers are increasingly informed about the benefits of electric vehicles, including reduced greenhouse gas emissions and lower carbon footprints. This heightened awareness is prompting a shift in consumer behavior, with more individuals seeking sustainable transportation options. As a result, the demand for electric vehicles is expected to rise, leading to an increased need for specialized transmission systems that cater to electric drivetrains. This trend is likely to bolster the Electric Vehicle Transmission Market as manufacturers respond to changing consumer preferences.

Technological Innovations in Transmission Systems

Technological advancements in transmission systems are crucial for the evolution of the Electric Vehicle Transmission Market. Innovations such as multi-speed transmissions and direct drive systems are being developed to enhance the efficiency and performance of electric vehicles. These technologies allow for better torque management and improved energy efficiency, which are essential for maximizing the range of electric vehicles. In 2025, it is anticipated that the integration of cutting-edge technologies will lead to a more competitive market, as manufacturers strive to differentiate their products. This focus on innovation is likely to stimulate growth within the Electric Vehicle Transmission Market.