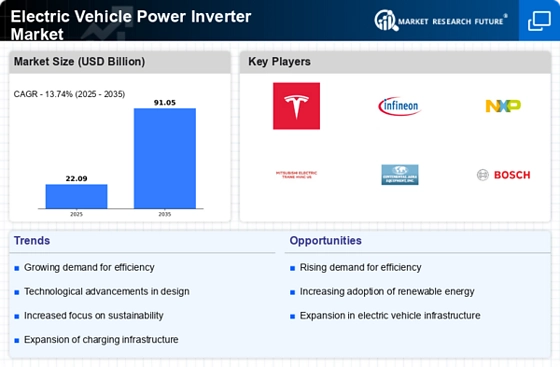

Rising Electric Vehicle Adoption

The increasing adoption of electric vehicles (EVs) is a primary driver for the Electric Vehicle Power Inverter Market. As consumers and businesses alike shift towards more sustainable transportation options, the demand for efficient power inverters rises. In 2025, it is estimated that the number of electric vehicles on the road will surpass 30 million units, significantly boosting the need for advanced power inverter technologies. These inverters play a crucial role in converting DC power from batteries to AC power for electric motors, thus enhancing vehicle performance. The growth in EV adoption is further supported by government incentives and regulations aimed at reducing carbon emissions, which in turn propels the Electric Vehicle Power Inverter Market forward.

Government Regulations and Incentives

Government regulations and incentives aimed at promoting electric vehicles are significantly influencing the Electric Vehicle Power Inverter Market. Many countries have implemented stringent emission standards and are offering financial incentives for EV purchases, which encourages consumers to transition from traditional vehicles. For instance, tax credits and rebates for electric vehicle buyers are becoming increasingly common, leading to a surge in demand for EVs and, consequently, power inverters. By 2025, it is anticipated that regulatory frameworks will become even more supportive, further stimulating the market. This regulatory environment not only fosters innovation in inverter technology but also ensures that the Electric Vehicle Power Inverter Market remains aligned with global sustainability objectives.

Growing Infrastructure for Electric Vehicles

The expansion of charging infrastructure is a crucial driver for the Electric Vehicle Power Inverter Market. As more charging stations are established, the convenience of owning an electric vehicle increases, thereby encouraging more consumers to make the switch. In 2025, the number of public charging stations is expected to exceed 1 million, creating a robust ecosystem for electric vehicles. This infrastructure development necessitates the integration of advanced power inverters that can efficiently manage the energy flow between the grid and electric vehicles. The synergy between charging infrastructure and power inverter technology is vital for the growth of the Electric Vehicle Power Inverter Market, as it enhances the overall user experience and supports the transition to electric mobility.

Consumer Awareness and Environmental Concerns

Increasing consumer awareness regarding environmental issues is driving the Electric Vehicle Power Inverter Market. As individuals become more conscious of their carbon footprint, the demand for electric vehicles rises, leading to a corresponding need for efficient power inverters. Surveys indicate that over 70% of potential car buyers consider environmental impact as a key factor in their purchasing decisions. This shift in consumer behavior is prompting manufacturers to invest in innovative inverter technologies that not only improve performance but also align with eco-friendly practices. By 2025, it is expected that the emphasis on sustainability will continue to grow, further propelling the Electric Vehicle Power Inverter Market as consumers seek greener alternatives in their transportation choices.

Technological Innovations in Power Electronics

Technological advancements in power electronics are reshaping the Electric Vehicle Power Inverter Market. Innovations such as silicon carbide (SiC) and gallium nitride (GaN) semiconductors are enabling the development of more efficient and compact inverters. These materials allow for higher switching frequencies and reduced energy losses, which are critical for enhancing the overall efficiency of electric vehicles. As of 2025, the market for SiC-based inverters is projected to grow at a compound annual growth rate (CAGR) of over 20%, indicating a strong trend towards adopting cutting-edge technologies. This evolution in power electronics not only improves vehicle performance but also contributes to the sustainability goals of the automotive industry, thereby driving the Electric Vehicle Power Inverter Market.