Growing Environmental Awareness

Growing environmental awareness among consumers is a driving force behind the Electric Vehicle Maintenance Market. As individuals become more conscious of their carbon footprint, the demand for electric vehicles continues to rise. This trend is accompanied by an increased focus on sustainable maintenance practices. Consumers are seeking maintenance services that align with their environmental values, prompting the industry to adopt greener practices. The Electric Vehicle Maintenance Market is likely to see a shift towards eco-friendly products and services, which could enhance brand loyalty and attract a broader customer base. This evolving landscape presents both challenges and opportunities for maintenance providers.

Advancements in Battery Technology

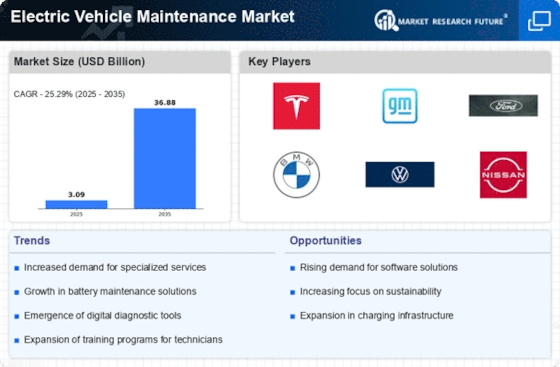

Advancements in battery technology significantly influence the Electric Vehicle Maintenance Market. As battery performance improves, the maintenance requirements for electric vehicles evolve. The introduction of solid-state batteries, for instance, may reduce the frequency of battery replacements, thereby altering maintenance schedules. However, these advancements also require specialized knowledge and tools for effective maintenance. The market for battery maintenance services is projected to grow, with estimates suggesting a compound annual growth rate of over 15% in the coming years. This trend indicates that the Electric Vehicle Maintenance Market must stay abreast of technological developments to provide adequate support and services for the latest battery technologies.

Increase in Electric Vehicle Adoption

The rise in electric vehicle adoption is a primary driver for the Electric Vehicle Maintenance Market. As more consumers opt for electric vehicles, the need for specialized maintenance services increases. In 2025, it is estimated that electric vehicles will account for approximately 30% of new car sales, leading to a substantial demand for maintenance solutions tailored to these vehicles. This shift necessitates the development of new maintenance protocols and tools, which could potentially reshape the landscape of the maintenance industry. The Electric Vehicle Maintenance Market must adapt to these changes by investing in innovative technologies and training programs to meet the evolving needs of electric vehicle owners.

Emergence of Smart Maintenance Solutions

The emergence of smart maintenance solutions is transforming the Electric Vehicle Maintenance Market. With the integration of IoT and AI technologies, maintenance processes are becoming more efficient and predictive. Smart diagnostics can identify potential issues before they escalate, allowing for timely interventions. This shift towards proactive maintenance is expected to enhance customer satisfaction and reduce overall maintenance costs. The market for smart maintenance solutions is anticipated to grow significantly, with projections indicating a potential increase of 20% annually. The Electric Vehicle Maintenance Market must embrace these innovations to remain competitive and meet the expectations of tech-savvy consumers.

Regulatory Support for Electric Vehicles

Regulatory support for electric vehicles plays a crucial role in shaping the Electric Vehicle Maintenance Market. Governments worldwide are implementing policies to encourage electric vehicle adoption, including tax incentives and subsidies. These initiatives not only boost sales but also create a corresponding demand for maintenance services. As regulations become more stringent regarding emissions and fuel efficiency, the maintenance of electric vehicles will likely become a focal point for compliance. The Electric Vehicle Maintenance Market must align its services with these regulatory frameworks to ensure that electric vehicle owners can meet legal requirements while maintaining their vehicles effectively.