Market Analysis

In-depth Analysis of Electric Vehicle Inverter Market Industry Landscape

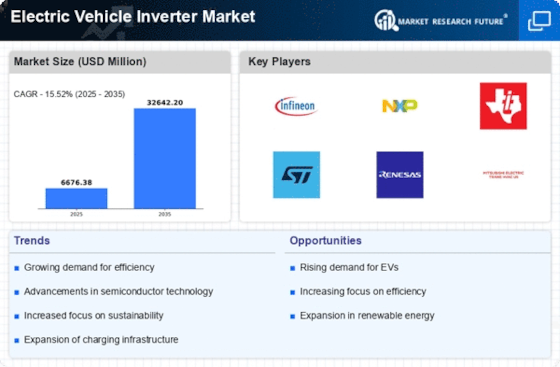

The electric vehicle inverter market is set to reach US$ 22.3 BN by 2032, at a 23.20% CAGR between years 2023-2032. The market trends of EV inverter make for a radical change in the automotive industry chiefly because the world is rapidly changing its ways towards environmentally friendly means of transport. Electric vehicles have a vital piece called an inverter that changes direct current (DC) produced by the battery to alternating current (AC) for the motor. Since the demand for electric cars increases, the market stands dynamic and transformative with each other day to cater to the needs of EV inverters. A prominent demand driver that is impacting the market trend is rising trends in acceptance of electric vehicles on a global scale. Policy-makers and consumers alike are embracing the move to green; the pressure coming from environmental side, as well as a need to reduce dependence on traditional petroleum products is significant.

The increasing EV adoption leads directly to the increase of demand for high-quality inverters, which in turn changes the competition on the market into a race toward improvement by innovating and achieving efficiency. The dynamics of market impacts that drive the technology development in electric automobile inverters are highly dependent on advances in technology. Manufacturers spend money on improving research on inverters for higher usability and power density that would lead to more range of the EV as well.

Inverters are gaining ground as the emergence of new applications blurring boundaries between broad and narrow solutions, which demands more compact, lightweight, and cost-effective inverters by automakers who seek viable solutions that can foster the broader quest for such ease. The dynamic market dynamics are also motivated by the regulatory milieu. Governments across the globe are making and strict requirements about emissions levels as well as compensating with various incentives for manufacturers to progressively produce electric vehicles. Where as in some areas on the other hand there are certain regulatory requirements which have to be met by manufacturers and these efficiency levels mandated may demand high standards that a manufacturer has to achieve plus surpass in order to survive in an ever-changing market.

Policy and practice dynamics determine how innovation progresses or the course of growth in a new market. Electric vehicle inverter market sends several dynamics and partnerships as crucial aspects. There was a strategic collaboration between manufacturers and suppliers in an effort to get such critical components like semiconductors and power modules easily and cheaply. Further, automotive manufacturers are collaborating with inverter producers to align their production based on the needs of an electric car platform that should not be separate from the vehicle design and functioning. These alliances enable effective scaled production as well as unified components that specify across various models for vehicles.

Leave a Comment