Consumer Awareness and Education

Consumer awareness and education regarding electric vehicles and their charging needs are essential drivers for the Electric Vehicle EV Charging Cables Market. As potential EV buyers become more informed about the benefits of electric mobility, including lower operating costs and environmental advantages, the interest in purchasing EVs increases. Educational initiatives by manufacturers and governments aim to demystify the charging process, highlighting the importance of using appropriate charging cables. This growing awareness is likely to lead to a more informed consumer base that demands high-quality charging solutions. As a result, the Electric Vehicle EV Charging Cables Market is expected to thrive, as manufacturers respond to the evolving preferences and requirements of consumers.

Rising Electric Vehicle Adoption

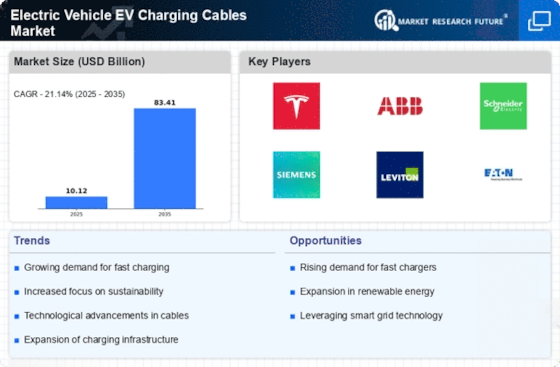

The increasing adoption of electric vehicles (EVs) is a primary driver for the Electric Vehicle EV Charging Cables Market. As consumers and businesses alike transition to EVs, the demand for compatible charging solutions surges. Recent data indicates that the number of electric vehicles on the road has seen a substantial rise, with projections suggesting that by 2025, the number of EVs could exceed 30 million units. This growth necessitates a corresponding increase in the availability and variety of charging cables, which are essential for efficient charging. The Electric Vehicle EV Charging Cables Market is thus positioned to benefit significantly from this trend, as manufacturers strive to meet the evolving needs of a burgeoning EV user base.

Expansion of Charging Infrastructure

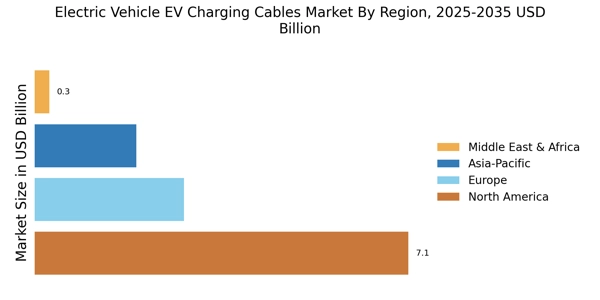

The expansion of charging infrastructure is a pivotal factor propelling the Electric Vehicle EV Charging Cables Market. As more charging stations are established in urban and rural areas, the accessibility of charging solutions for EV users improves significantly. Recent reports indicate that the number of public charging stations is projected to increase by over 50% by 2025, which will likely lead to a corresponding rise in the demand for charging cables. This infrastructure growth not only supports existing EV owners but also encourages potential buyers by alleviating range anxiety. Consequently, the Electric Vehicle EV Charging Cables Market stands to gain from this trend, as the need for diverse and reliable charging solutions becomes more pronounced.

Government Incentives and Regulations

Government policies and incentives play a crucial role in shaping the Electric Vehicle EV Charging Cables Market. Many countries have implemented regulations aimed at reducing carbon emissions, which often include financial incentives for EV purchases and the installation of charging infrastructure. For instance, tax credits and rebates for EV buyers can stimulate market growth, while mandates for charging stations in new developments enhance accessibility. As of 2025, various regions are expected to have stringent regulations that require a certain percentage of parking spaces to be equipped with EV charging capabilities. This regulatory environment fosters a robust demand for charging cables, as stakeholders seek to comply with new standards and capitalize on available incentives.

Technological Innovations in Charging Solutions

Technological advancements in charging solutions are significantly influencing the Electric Vehicle EV Charging Cables Market. Innovations such as ultra-fast charging capabilities and smart charging technologies are enhancing the efficiency and convenience of EV charging. For example, the development of high-capacity cables that can support rapid charging is becoming increasingly prevalent, allowing EVs to charge in a fraction of the time previously required. This trend is likely to attract more consumers to electric vehicles, thereby driving demand for advanced charging cables. As manufacturers invest in research and development to create cutting-edge products, the Electric Vehicle EV Charging Cables Market is expected to experience substantial growth, reflecting the ongoing evolution of charging technology.