Advancements in Busbar Technology

Technological innovations in busbar design and materials are propelling the Electric Vehicle Busbar Market forward. Recent advancements have led to the development of lightweight, high-conductivity materials that enhance the performance of busbars in electric vehicles. These innovations not only improve energy efficiency but also reduce the overall weight of the vehicle, contributing to better range and performance. The Electric Vehicle Busbar Market is witnessing a shift towards more sophisticated busbar systems that incorporate features such as thermal management and modular designs. As manufacturers continue to invest in R&D, the market is likely to see a proliferation of advanced busbar solutions tailored to meet the evolving needs of the electric vehicle sector.

Rising Demand for Electric Vehicles

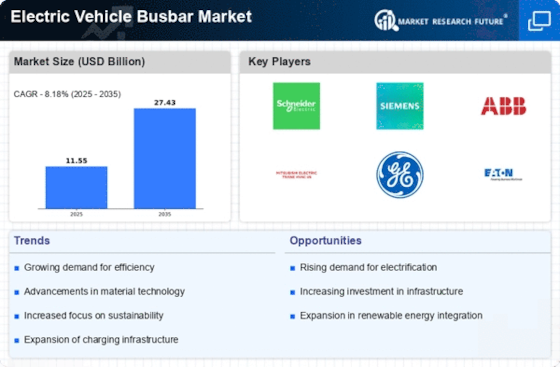

The increasing consumer preference for electric vehicles (EVs) is a primary driver for the Electric Vehicle Busbar Market. As more individuals and organizations recognize the environmental benefits and cost savings associated with EVs, the demand for efficient power distribution systems, such as busbars, is likely to rise. According to recent data, the EV market is projected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This surge in EV adoption necessitates advanced busbar solutions to ensure optimal performance and safety. Consequently, manufacturers in the Electric Vehicle Busbar Market are focusing on developing innovative busbar designs that can handle higher power loads and improve energy efficiency.

Expansion of Charging Infrastructure

The rapid expansion of electric vehicle charging infrastructure is a crucial driver for the Electric Vehicle Busbar Market. As more charging stations are established, the need for robust and efficient power distribution systems becomes increasingly apparent. Busbars play a vital role in ensuring that charging stations can deliver the necessary power to multiple vehicles simultaneously. Recent reports indicate that the number of public charging stations is expected to increase significantly, which will, in turn, boost the demand for busbars. The Electric Vehicle Busbar Market is likely to see heightened activity as manufacturers respond to this growing need, focusing on developing busbar solutions that can support the scalability and reliability of charging networks.

Government Initiatives and Incentives

Government policies and incentives aimed at promoting electric mobility are significantly influencing the Electric Vehicle Busbar Market. Various countries have implemented subsidies, tax breaks, and grants to encourage the adoption of electric vehicles. For instance, initiatives that support the installation of EV charging infrastructure directly impact the demand for busbars, as these components are essential for efficient energy distribution. The Electric Vehicle Busbar Market is expected to benefit from these favorable policies, which may lead to increased investments in research and development. As governments continue to prioritize sustainability, the market for busbars is likely to expand, driven by the need for reliable and efficient power distribution systems.

Growing Focus on Renewable Energy Integration

The increasing emphasis on integrating renewable energy sources into the electric vehicle ecosystem is shaping the Electric Vehicle Busbar Market. As more EVs are charged using renewable energy, the demand for efficient busbar systems that can handle variable power inputs is likely to rise. This trend aligns with global efforts to reduce carbon emissions and promote sustainable energy solutions. The Electric Vehicle Busbar Market is expected to adapt to these changes by developing busbars that facilitate seamless integration with solar and wind energy systems. This shift not only enhances the sustainability of electric vehicles but also positions busbars as critical components in the transition towards a greener energy landscape.