North America : Mature Market with Steady Growth

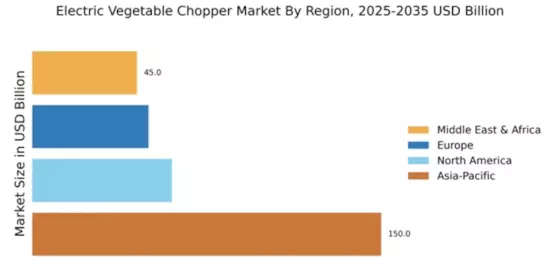

The North American electric vegetable chopper market is projected to reach $60.0 million by 2025, driven by increasing consumer demand for convenience and efficiency in food preparation. The region's growth is supported by a rising trend towards healthy eating, leading to higher vegetable consumption. Regulatory support for kitchen appliances, emphasizing safety and energy efficiency, further catalyzes market expansion. Leading countries in this region include the US and Canada, where major players like Cuisinart, Black+Decker, and Hamilton Beach dominate the market. The competitive landscape is characterized by innovation in product features, such as multi-functionality and ease of cleaning. As consumers seek high-quality and reliable kitchen appliances, the presence of established brands ensures a robust market environment.

Europe : Innovation and Sustainability Focus

Europe's electric vegetable chopper market is valued at $50.0 million, with a strong emphasis on innovation and sustainability. The region is witnessing a shift towards eco-friendly appliances, driven by consumer awareness and regulatory initiatives aimed at reducing environmental impact. This trend is expected to boost market growth as manufacturers adapt to meet these demands. Germany, France, and the UK are leading markets, with key players like Braun and Tefal enhancing their product offerings. The competitive landscape is marked by a focus on energy-efficient designs and smart technology integration. As European consumers prioritize sustainability, brands that align with these values are likely to gain a competitive edge.

Asia-Pacific : Rapid Growth and Market Leadership

The Asia-Pacific electric vegetable chopper market is the largest globally, with a market size of $150.0 million. This growth is fueled by urbanization, rising disposable incomes, and a growing preference for convenience in food preparation. The region's diverse culinary practices also drive demand for versatile kitchen appliances. Regulatory frameworks promoting food safety and energy efficiency further support market expansion. China, Japan, and India are the leading countries in this market, with significant contributions from brands like Panasonic and Philips. The competitive landscape is vibrant, with numerous local and international players vying for market share. As consumer preferences evolve, innovation in product features and affordability will be key to maintaining market leadership.

Middle East and Africa : Emerging Market with Growth Potential

The Middle East and Africa electric vegetable chopper market is valued at $45.0 million, showing significant growth potential. Factors such as increasing urbanization, changing lifestyles, and a growing middle class are driving demand for kitchen appliances. Additionally, the region's culinary diversity encourages the adoption of electric choppers for efficient food preparation. Regulatory initiatives aimed at improving product safety and quality standards are also contributing to market growth. Countries like South Africa and the UAE are leading the market, with a mix of local and international brands competing for consumer attention. Key players are focusing on affordability and functionality to cater to the diverse needs of consumers. As the market matures, innovation and brand loyalty will play crucial roles in shaping the competitive landscape.