North America : Market Leader in Maintenance

North America is poised to maintain its leadership in the Electric Motor and Drive System Maintenance Market, holding a significant market share of 12.0 in 2024. The region's growth is driven by increasing industrial automation, stringent regulatory standards, and a focus on energy efficiency. The demand for advanced maintenance solutions is further fueled by the rising adoption of electric vehicles and renewable energy technologies, which necessitate efficient motor systems.

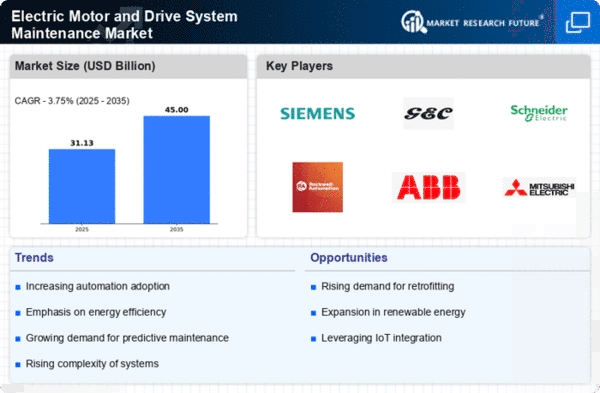

The competitive landscape in North America is robust, featuring key players such as Siemens AG, General Electric Company, and Rockwell Automation. These companies are investing heavily in R&D to innovate and enhance their service offerings. The presence of a well-established manufacturing base and a skilled workforce further strengthens the market. As industries increasingly prioritize sustainability, the demand for electric motor maintenance services is expected to grow, solidifying North America's position as a market leader.

Europe : Innovation and Sustainability Focus

Europe is experiencing a significant shift in the Electric Motor and Drive System Maintenance Market, with a market size of 9.0 in 2024. The region's growth is driven by stringent environmental regulations and a strong emphasis on sustainability. The European Union's commitment to reducing carbon emissions is propelling the adoption of electric motors, thereby increasing the demand for maintenance services. Additionally, advancements in technology are enabling predictive maintenance, which enhances operational efficiency.

Leading countries such as Germany, France, and the UK are at the forefront of this market, with major players like Schneider Electric and ABB Ltd. dominating the landscape. The competitive environment is characterized by innovation and collaboration, as companies seek to develop smart maintenance solutions. The presence of a skilled workforce and strong governmental support for green initiatives further bolster the market's growth potential.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is emerging as a significant player in the Electric Motor and Drive System Maintenance Market, with a market size of 7.5 in 2024. The region's growth is driven by rapid industrialization, urbanization, and increasing investments in infrastructure. Countries like China and India are witnessing a surge in demand for electric motors, particularly in manufacturing and transportation sectors. Government initiatives aimed at promoting electric vehicles are also contributing to market expansion.

The competitive landscape is evolving, with key players such as Mitsubishi Electric and Yaskawa Electric Corporation leading the charge. The presence of a large manufacturing base and a growing focus on automation are key factors driving the market. As the region continues to invest in technology and innovation, the demand for maintenance services is expected to rise, positioning Asia-Pacific as a vital market for future growth.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is gradually emerging in the Electric Motor and Drive System Maintenance Market, with a market size of 1.5 in 2024. The growth is primarily driven by increasing industrial activities and a focus on infrastructure development. Countries in the Gulf Cooperation Council (GCC) are investing heavily in modernization and automation, which is expected to boost the demand for electric motor maintenance services. Additionally, the region's efforts to diversify its economy away from oil dependency are fostering new opportunities in various sectors.

Leading countries such as South Africa and the UAE are witnessing a rise in demand for electric motors across industries like manufacturing and energy. The competitive landscape is characterized by a mix of local and international players, with companies looking to establish a foothold in this emerging market. As investments in technology and infrastructure continue, the Middle East and Africa are poised for significant growth in the electric motor maintenance sector.