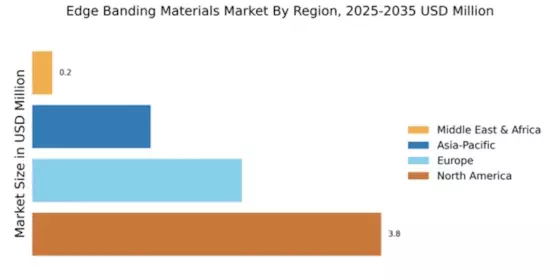

Market Growth Projections

The Global Edge Banding Materials Market Industry is poised for substantial growth, with projections indicating a rise from 1.02 USD Billion in 2024 to 2.77 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 9.5% from 2025 to 2035, reflecting increasing demand across various sectors, including furniture manufacturing and construction. The market's expansion is likely to be driven by technological advancements, sustainability trends, and the evolving preferences of consumers seeking high-quality and aesthetically pleasing products.

Rising Demand for Furniture

The Global Edge Banding Materials Market Industry experiences a surge in demand driven by the increasing production of furniture. As consumers prioritize aesthetics and durability, manufacturers are utilizing edge banding materials to enhance the visual appeal and longevity of furniture products. In 2024, the market is projected to reach 1.02 USD Billion, reflecting the growing trend towards customized and high-quality furniture solutions. This demand is particularly evident in regions with robust furniture manufacturing sectors, such as Europe and North America, where innovative designs and sustainable materials are becoming essential.

Growth in Construction Activities

The Global Edge Banding Materials Market Industry is significantly influenced by the expansion of construction activities worldwide. As urbanization accelerates, the need for residential and commercial spaces increases, leading to a higher demand for interior furnishings that utilize edge banding materials. The construction sector's growth contributes to the projected market value of 2.77 USD Billion by 2035, indicating a robust trajectory. Countries with booming construction industries, such as India and China, are particularly noteworthy, as they adopt modern building practices that incorporate advanced edge banding solutions.

Expansion of Retail and E-commerce Sectors

The expansion of retail and e-commerce sectors is a key driver for the Global Edge Banding Materials Market Industry. As online shopping continues to grow, the demand for ready-to-assemble furniture and customized interior solutions increases. Retailers are increasingly offering products that utilize edge banding materials to enhance their appeal and functionality. This trend is particularly pronounced in regions with high e-commerce penetration, such as North America and Europe, where consumers seek convenience and quality in their purchases. The market's growth trajectory is expected to be bolstered by this retail evolution.

Sustainability Trends in Material Selection

Sustainability trends are increasingly influencing the Global Edge Banding Materials Market Industry as consumers and manufacturers alike prioritize eco-friendly materials. The demand for sustainable edge banding solutions, such as those made from recycled or bio-based materials, is on the rise. This shift is driven by regulatory pressures and consumer preferences for environmentally responsible products. As a result, manufacturers are investing in research and development to create innovative edge banding materials that meet these sustainability criteria, further propelling market growth and aligning with global environmental goals.

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes are reshaping the Global Edge Banding Materials Market Industry. Innovations in production techniques, such as automated edge banding machines and improved adhesive formulations, enhance the efficiency and quality of edge banding applications. These advancements not only reduce production costs but also improve the durability and aesthetic appeal of finished products. As manufacturers adopt these technologies, the market is expected to grow at a CAGR of 9.5% from 2025 to 2035, reflecting a shift towards more efficient and sustainable manufacturing practices.