Edge Banding Materials Size

Edge Banding Materials Market Growth Projections and Opportunities

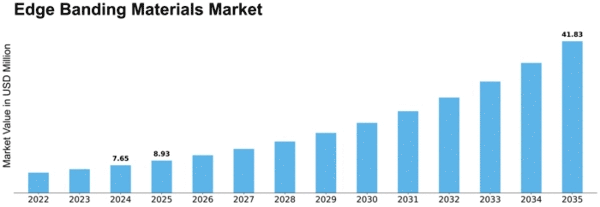

The market for edge banding materials is projected to grow at a rate of 9.6% per year and reach USD 1,754.19 Million by the end of 2030.

The worldwide market for edge banding materials is affected by many factors, which direct impact on the growth and trajectory as a business. They include a strong presence in furniture and woodworking sectors where they are used as tools for improving the aesthetic values, durability and enhancing other properties of furniture products. These materials help cover exposed furniture edges thus providing finishes which look unified while offering resistance against wear and tear plus moisture damage. This market’s growth has largely been boosted by demand for furniture over the years with the influence of urbanization, lifestyle changes; home improvement trends among others.

Additionally, construction activities also drive edge banding materials’ demand. It is heavily employed when making cabinets and countertops in both residential and commercial spaces. Henceforth, with increasing housing projects coupled with infrastructural ones thereby leading to swell in the construction industry; it consequently helps fuel demand for edge banding materials too. In addition, their viability within different areas such as office space or even bathroom and kitchen use further enhances their market performance in this sector.

Thereby does design trends together with consumer preferences affect this kind of business significantly? Consequently where consumers are demanding more and more customized good looking furniture; more options are needed for edging bands that have different colors spot textures or paint coatings. Therefore dealing with these requests some manufacturers offer several kinds: PVC’s Melamine Veneer Wood ABS- allowing quality designers or makers ensure that they meet all marketing objectives.

Additionally there have been significant improvements on this line technologically speaking across various industries regarding edge banding materials invention. This makes companies spend considerable amounts on research geared at enhancing the characteristics of edge banding materials including more strength, higher moisture resistance and better adhesion properties. Also, companies have developed other edging technologies which are seamless and provide a finer surface that satisfies the demand for quality high-end furniture.

Leave a Comment