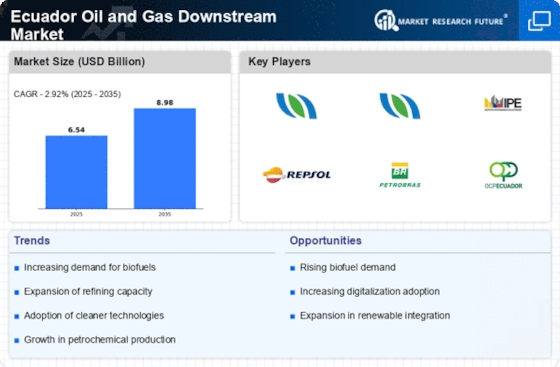

Rising Domestic Demand for Fuels

Rising domestic demand for fuels is emerging as a key driver in the Ecuador Oil and Gas Downstream Market. As the economy continues to grow, the consumption of petroleum products is expected to increase, driven by factors such as urbanization and industrial expansion. Recent statistics suggest that fuel consumption in Ecuador has been on an upward trajectory, with projections indicating a potential increase of over 5% annually in the coming years. This growing demand necessitates enhancements in refining capacity and distribution networks to ensure that supply meets consumer needs. Additionally, the government is likely to prioritize investments in the downstream sector to address this rising demand, which could lead to further developments in the industry. Thus, domestic fuel demand is poised to significantly influence the dynamics of the Ecuador Oil and Gas Downstream Market.

Regulatory Framework Enhancements

The Ecuador Oil and Gas Downstream Market is currently experiencing a transformation due to enhancements in the regulatory framework. The government has been actively revising policies to attract foreign investment and improve operational efficiency. Recent reforms aim to streamline licensing processes and reduce bureaucratic hurdles, which could potentially lead to increased participation from international players. This shift may result in a more competitive landscape, fostering innovation and efficiency within the sector. Furthermore, the government's commitment to environmental regulations is likely to shape operational practices, pushing companies to adopt cleaner technologies. As a result, the regulatory environment appears to be a crucial driver for growth in the Ecuador Oil and Gas Downstream Market.

Investment in Infrastructure Development

Investment in infrastructure development is a pivotal driver for the Ecuador Oil and Gas Downstream Market. The government has recognized the necessity of modernizing existing facilities and constructing new ones to enhance capacity and efficiency. Recent data indicates that planned investments in refining and distribution infrastructure could exceed several hundred million dollars over the next few years. This influx of capital is expected to improve supply chain logistics, reduce operational costs, and ultimately enhance product availability across the nation. Additionally, improved infrastructure may facilitate better access to international markets, thereby expanding the reach of Ecuadorian oil and gas products. Consequently, infrastructure development is likely to play a significant role in shaping the future of the Ecuador Oil and Gas Downstream Market.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are increasingly shaping the landscape of the Ecuador Oil and Gas Downstream Market. Companies are recognizing the value of forming alliances to leverage complementary strengths and share resources. Such collaborations can facilitate knowledge transfer, enhance operational capabilities, and improve market access. Recent trends indicate that joint ventures between local firms and international players are becoming more common, particularly in refining and distribution sectors. These partnerships may enable companies to tap into new technologies and best practices, ultimately driving efficiency and innovation. As the market evolves, the establishment of strategic alliances is likely to play a crucial role in enhancing competitiveness within the Ecuador Oil and Gas Downstream Market.

Technological Innovations in Refining Processes

Technological innovations in refining processes are becoming increasingly influential in the Ecuador Oil and Gas Downstream Market. The adoption of advanced refining technologies can enhance efficiency, reduce emissions, and improve product quality. Recent advancements, such as the implementation of digital monitoring systems and automation, are expected to optimize operations and minimize downtime. Furthermore, these innovations may lead to cost reductions, allowing companies to remain competitive in a fluctuating market. As the industry seeks to align with global sustainability goals, the integration of cleaner technologies is likely to gain traction. Consequently, technological advancements are anticipated to be a driving force in the evolution of the Ecuador Oil and Gas Downstream Market.