Rising Energy Efficiency Standards

The Global Economizer Market Industry is experiencing a surge in demand due to increasingly stringent energy efficiency standards imposed by governments worldwide. These regulations aim to reduce energy consumption and greenhouse gas emissions, compelling industries to adopt advanced economizer systems. For instance, the implementation of the Energy Policy Act in the United States has driven many facilities to upgrade their systems, resulting in significant energy savings. As a result, the market is projected to reach 4.86 USD Billion in 2024, reflecting a growing emphasis on sustainable practices across various sectors.

Growing Industrialization and Urbanization

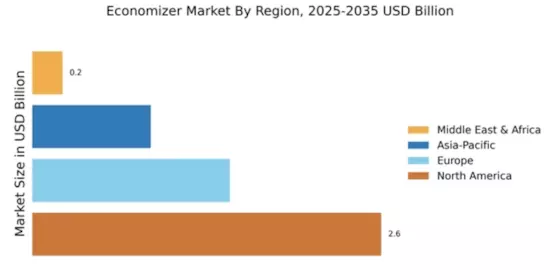

The Global Economizer Market Industry is significantly influenced by the rapid industrialization and urbanization occurring in developing regions. As countries expand their industrial base, the demand for energy-efficient solutions becomes paramount. For instance, nations in Asia-Pacific are witnessing a surge in manufacturing activities, which necessitates the adoption of economizer systems to manage energy costs effectively. This trend is likely to drive the market forward, as industries seek to comply with environmental regulations while optimizing operational efficiency. The anticipated CAGR of 5.46% from 2025 to 2035 underscores the potential for growth in this sector.

Regulatory Incentives for Energy Efficiency

Regulatory incentives provided by governments worldwide are further propelling the Global Economizer Market Industry. Various initiatives, such as tax credits and rebates for energy-efficient upgrades, encourage businesses to invest in economizer systems. These incentives reduce the financial burden associated with implementing new technologies, making it more feasible for companies to adopt energy-efficient solutions. For instance, programs in Europe have successfully incentivized industries to upgrade their economizer systems, leading to substantial energy savings. Such regulatory support is likely to sustain market growth, as more businesses recognize the long-term benefits of energy efficiency.

Increasing Focus on Renewable Energy Integration

The Global Economizer Market Industry is also benefiting from the increasing focus on integrating renewable energy sources into existing systems. As industries strive to reduce their carbon footprint, economizers are being utilized to enhance the efficiency of renewable energy systems, such as solar and wind. By optimizing energy recovery processes, these systems can significantly improve overall energy utilization. For example, economizers can be employed in conjunction with biomass boilers to maximize energy output. This trend not only supports sustainability goals but also positions the market for robust growth in the coming years.

Technological Advancements in Economizer Systems

Technological innovations play a pivotal role in the Global Economizer Market Industry, enhancing the performance and efficiency of economizer systems. Recent advancements, such as the integration of IoT and smart sensors, allow for real-time monitoring and optimization of energy usage. These technologies not only improve operational efficiency but also reduce maintenance costs. For example, smart economizers can adjust their operation based on real-time data, leading to energy savings of up to 30%. This trend is expected to contribute to the market's growth, with projections indicating a rise to 8.72 USD Billion by 2035.