Regulatory Compliance

Regulatory compliance is becoming increasingly critical for businesses, thereby impacting the EAS Antennas Market. Governments and regulatory bodies are imposing stricter guidelines regarding theft prevention and asset protection, compelling organizations to adopt EAS systems. Compliance with these regulations not only helps businesses avoid penalties but also enhances their reputation among consumers. As companies strive to meet these standards, the demand for EAS antennas is expected to rise. This trend suggests that the EAS Antennas Market will continue to grow as businesses prioritize compliance and invest in effective security solutions to protect their assets.

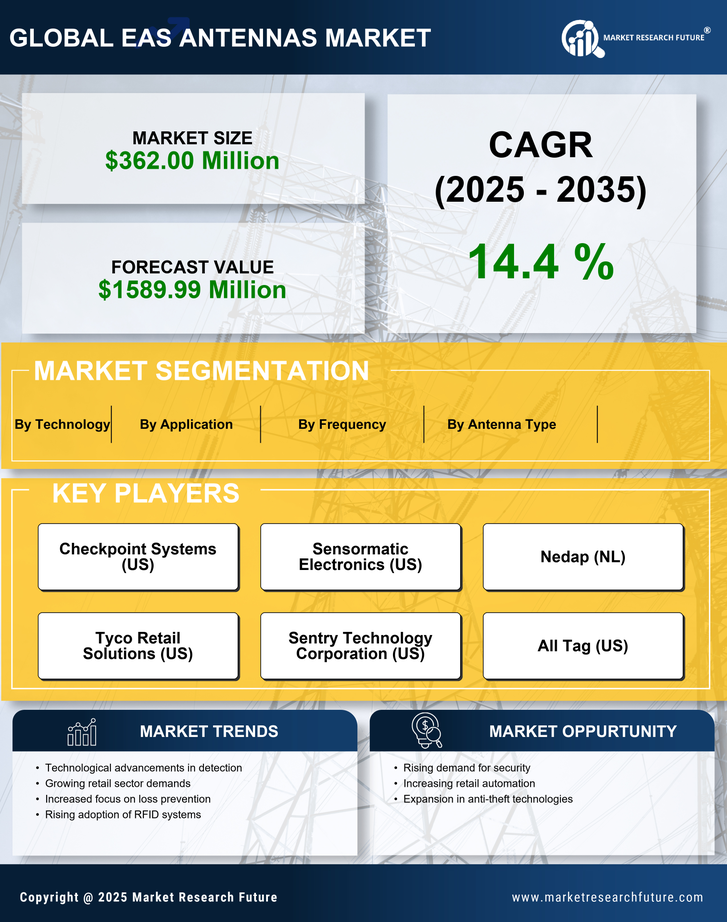

Rising Security Concerns

The EAS Antennas Market is experiencing a surge in demand due to escalating security concerns across various sectors. Retailers, in particular, are increasingly investing in electronic article surveillance systems to mitigate theft and enhance loss prevention strategies. According to recent data, retail theft has been on the rise, prompting businesses to adopt more robust security measures. The integration of EAS antennas not only deters shoplifting but also provides a sense of safety for customers and employees alike. As a result, the EAS Antennas Market is likely to witness substantial growth as organizations prioritize security investments to protect their assets and maintain operational integrity.

Technological Innovations

Technological advancements play a pivotal role in shaping the EAS Antennas Market. Innovations such as RFID technology and advanced sensor systems are enhancing the effectiveness of EAS solutions. These technologies enable real-time tracking and monitoring of inventory, thereby reducing shrinkage and improving operational efficiency. The market is projected to grow as retailers and manufacturers increasingly adopt these cutting-edge solutions to streamline their operations. Furthermore, the integration of artificial intelligence and machine learning into EAS systems is expected to provide valuable insights into consumer behavior, further driving the demand for sophisticated EAS antennas. This trend indicates a promising future for the EAS Antennas Market.

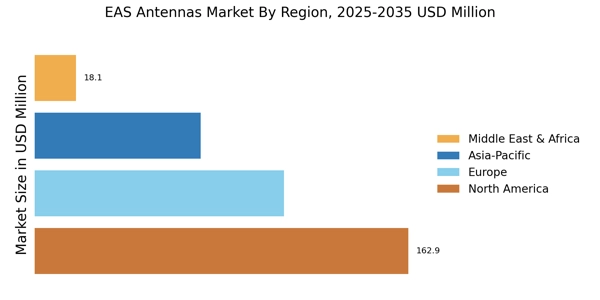

Expansion of Retail Outlets

The expansion of retail outlets is significantly influencing the EAS Antennas Market. As new stores open and existing ones expand, the need for effective loss prevention measures becomes paramount. Retailers are recognizing the importance of implementing EAS systems to safeguard their merchandise. Recent statistics indicate that the retail sector is projected to grow steadily, leading to an increased demand for EAS antennas. This growth is particularly evident in emerging markets, where the establishment of new retail chains is on the rise. Consequently, the EAS Antennas Market is poised for growth as retailers seek to enhance their security measures in tandem with their expansion efforts.

Consumer Awareness and Demand

Consumer awareness regarding theft and loss prevention is driving the EAS Antennas Market. As shoppers become more informed about the measures retailers are taking to protect their products, there is a growing expectation for enhanced security in stores. This awareness is prompting retailers to invest in EAS systems to meet consumer demands for safety and security. Market data indicates that consumers are more likely to shop at stores that demonstrate a commitment to loss prevention. Consequently, the EAS Antennas Market is likely to benefit from this trend, as retailers seek to align their security measures with consumer expectations.