Expansion of 5G Technology

The rollout of 5G technology is significantly impacting the DUV Lithography System Market. As telecommunications companies invest in infrastructure to support 5G networks, the demand for high-performance chips is escalating. These chips require advanced lithography techniques to achieve the necessary miniaturization and performance levels. The 5G market is anticipated to reach over 700 billion USD by 2025, which will likely drive the need for DUV lithography systems. This expansion presents opportunities for manufacturers to enhance their production capabilities and cater to the growing demand for 5G-enabled devices, thereby solidifying the relevance of DUV lithography in the semiconductor manufacturing process.

Technological Innovations in Lithography

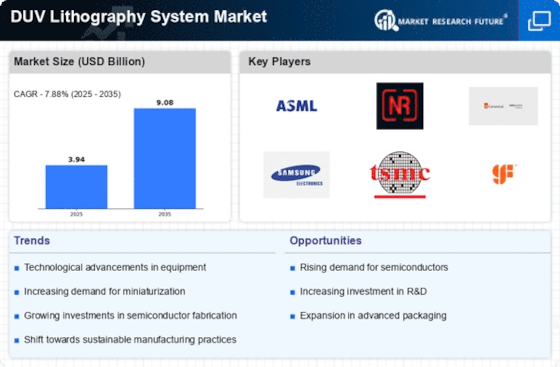

Technological advancements play a pivotal role in shaping the DUV Lithography System Market. Innovations such as improved optics, enhanced light sources, and advanced materials are driving the efficiency and precision of lithography processes. The introduction of extreme ultraviolet (EUV) lithography has also influenced DUV systems, as manufacturers seek to optimize their existing technologies. As of 2025, the market for DUV lithography systems is expected to witness a compound annual growth rate (CAGR) of around 5%, reflecting the ongoing investment in research and development. These innovations not only improve yield rates but also reduce production costs, making DUV systems increasingly attractive to semiconductor manufacturers.

Rising Demand for Advanced Semiconductor Devices

The DUV Lithography System Market is experiencing a surge in demand driven by the increasing need for advanced semiconductor devices. As technology progresses, the complexity of chips continues to rise, necessitating more sophisticated lithography techniques. The market for semiconductor devices is projected to reach approximately 1 trillion USD by 2025, indicating a robust growth trajectory. This demand is primarily fueled by the proliferation of consumer electronics, automotive applications, and the expansion of the Internet of Things (IoT). Consequently, manufacturers are investing heavily in DUV lithography systems to enhance production capabilities and meet the evolving requirements of the semiconductor landscape.

Increased Investment in Semiconductor Manufacturing

The DUV Lithography System Market is benefiting from heightened investment in semiconductor manufacturing facilities. Governments and private entities are recognizing the strategic importance of semiconductor production, leading to substantial funding initiatives. For instance, several countries have announced multi-billion dollar investments to bolster domestic semiconductor manufacturing capabilities. This trend is expected to create a favorable environment for DUV lithography systems, as manufacturers seek to upgrade their equipment to meet the increasing production demands. By 2025, the semiconductor manufacturing sector is projected to grow significantly, further solidifying the role of DUV lithography systems in meeting the industry's evolving needs.

Growing Focus on Miniaturization of Electronic Components

The trend towards miniaturization in the electronics industry is a key driver for the DUV Lithography System Market. As devices become smaller and more powerful, the need for precise lithography techniques becomes paramount. This miniaturization trend is evident in various sectors, including consumer electronics, automotive, and medical devices. The market for miniaturized electronic components is expected to expand rapidly, with projections indicating a growth rate of approximately 6% annually through 2025. This growth necessitates the adoption of advanced DUV lithography systems, which can produce smaller features with high accuracy, thereby enabling manufacturers to meet the demands of an increasingly compact and efficient electronic landscape.