Urbanization Trends

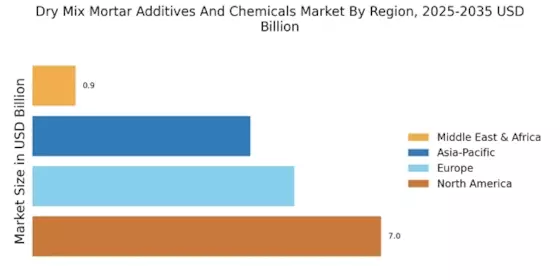

Rapid urbanization is a critical driver of the Dry Mix Mortar Additives And Chemicals Market. As populations migrate to urban areas, the demand for residential and commercial infrastructure escalates. This trend necessitates the use of efficient construction materials, including dry mix mortars, which offer advantages such as ease of application and reduced labor costs. According to recent data, urban areas are projected to house nearly 70% of the world's population by 2050, leading to an increased need for construction solutions. Consequently, the demand for high-quality dry mix mortar additives that enhance the performance and longevity of structures is expected to surge, further stimulating growth in the market.

Regulatory Compliance

The evolving landscape of construction regulations and standards is influencing the Dry Mix Mortar Additives And Chemicals Market. Governments are increasingly implementing stringent guidelines to ensure safety, quality, and environmental protection in construction practices. Compliance with these regulations often necessitates the use of specialized additives that meet specific performance criteria. For instance, additives that enhance fire resistance, water repellency, and thermal insulation are becoming essential in meeting regulatory demands. As a result, manufacturers are focusing on developing products that not only comply with regulations but also provide added value to end-users. This trend is likely to drive innovation and growth within the dry mix mortar additives and chemicals sector.

Technological Innovations

Technological advancements in the formulation and application of dry mix mortars are likely to propel the Dry Mix Mortar Additives And Chemicals Market. Innovations such as the development of high-performance additives that improve adhesion, workability, and durability are becoming increasingly prevalent. The integration of smart technologies, including sensors and automation in mixing processes, enhances efficiency and consistency. Furthermore, research indicates that the use of advanced polymers and additives can significantly reduce curing times and improve overall performance. As construction projects demand higher quality and faster completion times, the adoption of these technologies is expected to rise, thereby expanding the market for dry mix mortar additives and chemicals.

Sustainability Initiatives

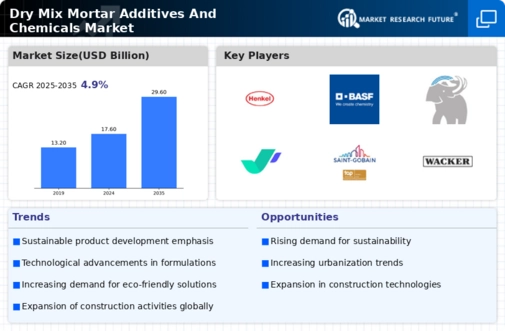

The increasing emphasis on sustainability within the construction sector appears to drive the Dry Mix Mortar Additives And Chemicals Market. As environmental regulations become more stringent, manufacturers are compelled to develop eco-friendly products. This shift is evident in the rising demand for additives that enhance the performance of dry mix mortars while minimizing environmental impact. For instance, the incorporation of recycled materials and bio-based additives is gaining traction. The market for sustainable construction materials is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. Consequently, companies that prioritize sustainability in their product offerings may gain a competitive edge in the Dry Mix Mortar Additives And Chemicals Market.

Rising Construction Activities

The resurgence of construction activities across various sectors is a prominent driver of the Dry Mix Mortar Additives And Chemicals Market. With increasing investments in infrastructure development, residential projects, and commercial buildings, the demand for construction materials is on the rise. Recent statistics indicate that construction spending is expected to reach trillions of dollars in the next few years, creating a substantial market for dry mix mortars. These materials are favored for their efficiency and versatility, making them suitable for a wide range of applications. As construction projects continue to proliferate, the need for high-performance dry mix mortar additives and chemicals is anticipated to grow, thereby bolstering the market.