Rising Urban Population

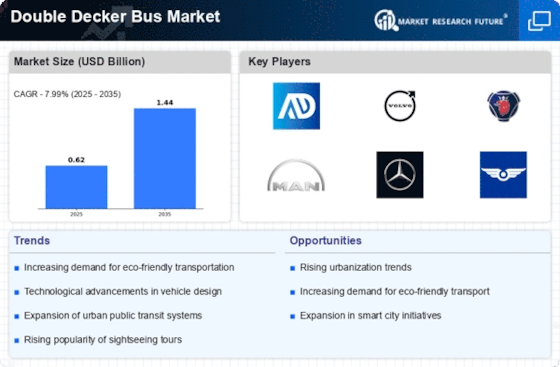

The increasing urban population is a pivotal driver for the Double Decker Bus Market. As cities expand, the demand for efficient public transportation solutions intensifies. According to recent data, urban areas are projected to house over 68% of the world's population by 2050. This demographic shift necessitates the development of robust public transport systems, where double decker buses play a crucial role. Their capacity to accommodate more passengers while reducing traffic congestion makes them an attractive option for city planners. Furthermore, the integration of double decker buses into urban transport networks can enhance accessibility and reduce travel times, thereby promoting their adoption in metropolitan areas. Consequently, the rising urban population is likely to propel the growth of the Double Decker Bus Market in the coming years.

Environmental Regulations

Stringent environmental regulations are increasingly influencing the Double Decker Bus Market. Governments worldwide are implementing policies aimed at reducing carbon emissions and promoting sustainable transportation. For instance, many cities are mandating the use of low-emission vehicles in public transport fleets. This regulatory environment encourages the adoption of double decker buses, particularly those equipped with hybrid or electric propulsion systems. The market for electric double decker buses is expected to grow significantly, as manufacturers respond to these regulations by innovating cleaner technologies. In fact, the demand for environmentally friendly public transport solutions is projected to rise, with double decker buses being at the forefront of this transition. As a result, compliance with environmental standards is likely to drive the expansion of the Double Decker Bus Market.

Technological Innovations

Technological innovations are reshaping the Double Decker Bus Market, enhancing operational efficiency and passenger experience. The integration of advanced technologies such as GPS tracking, real-time passenger information systems, and automated ticketing solutions is becoming commonplace. These innovations not only streamline operations but also improve the overall user experience, making public transport more appealing. Additionally, the advent of smart city initiatives is further propelling the adoption of double decker buses, as cities seek to leverage technology to optimize transport networks. Data indicates that the implementation of smart technologies in public transport can lead to a 20% increase in ridership. Therefore, the ongoing technological advancements are likely to serve as a catalyst for growth within the Double Decker Bus Market.

Tourism and Sightseeing Demand

The demand for tourism and sightseeing services is a significant driver for the Double Decker Bus Market. Double decker buses are often associated with city tours, providing an elevated vantage point for tourists to enjoy scenic views. As travel and tourism continue to rebound, cities are increasingly investing in double decker bus services to cater to visitors. This trend is particularly evident in major tourist destinations, where these buses serve as a convenient and attractive mode of transport. Market data suggests that the sightseeing bus segment is expected to grow at a compound annual growth rate of 5% over the next five years. Consequently, the rising demand for tourism-related transport solutions is likely to bolster the growth of the Double Decker Bus Market.

Government Investments in Public Transport

Government investments in public transport infrastructure are a crucial driver for the Double Decker Bus Market. Many governments are recognizing the importance of efficient public transport systems in reducing traffic congestion and promoting sustainable urban mobility. As a result, substantial funding is being allocated to enhance public transport networks, including the procurement of double decker buses. Recent reports indicate that public transport investment is expected to reach trillions of dollars over the next decade. This influx of capital is likely to facilitate the expansion of double decker bus fleets, improving service frequency and coverage. Furthermore, government initiatives aimed at modernizing public transport are expected to create a favorable environment for the growth of the Double Decker Bus Market.