Rising Demand for Eco-Friendly Solutions

The Document Scanner Market is increasingly influenced by the rising demand for eco-friendly solutions. As organizations strive to reduce their carbon footprint, the shift towards paperless operations is becoming more pronounced. Document scanners play a crucial role in this transition by enabling the digitization of paper documents, thus minimizing waste. Recent surveys indicate that approximately 70% of businesses are actively seeking sustainable practices, which includes investing in energy-efficient scanning devices. This growing awareness of environmental issues is likely to drive the demand for document scanners that are designed with sustainability in mind, further propelling the Document Scanner Market.

Growing Adoption of Remote Work Solutions

The Document Scanner Market is witnessing a notable increase in adoption due to the rise of remote work solutions. As organizations adapt to flexible work environments, the need for efficient document management systems becomes critical. Scanners that facilitate easy digitization of documents are essential for remote teams to maintain productivity and collaboration. Recent statistics indicate that the remote work trend has led to a 15% increase in the demand for document scanning devices. This shift not only enhances workflow efficiency but also supports the need for secure document sharing among remote employees. Consequently, the Document Scanner Market is poised for growth as companies invest in tools that enable seamless remote operations.

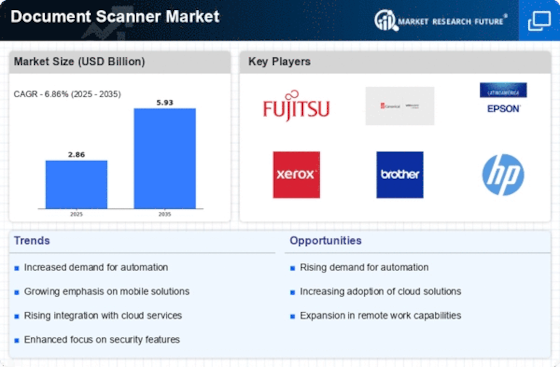

Increased Demand for Digital Transformation

The Document Scanner Market is experiencing a surge in demand driven by the ongoing digital transformation across various sectors. Organizations are increasingly adopting digital solutions to streamline operations, reduce paper usage, and enhance efficiency. According to recent data, the market for document scanners is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This trend is particularly evident in sectors such as healthcare, finance, and education, where the need for digitization of records is paramount. As businesses seek to improve their workflows and reduce operational costs, the Document Scanner Market is likely to benefit significantly from this shift towards digitalization.

Regulatory Compliance and Document Security

The Document Scanner Market is significantly influenced by the increasing emphasis on regulatory compliance and document security. Organizations are mandated to adhere to various regulations regarding data protection and record-keeping, which necessitates the use of reliable scanning solutions. The market is projected to expand as businesses seek scanners that offer advanced security features, such as encryption and secure cloud storage. Recent data suggests that compliance-related investments in document management systems are expected to rise by 20% in the coming years. This focus on security and compliance is likely to drive the demand for sophisticated document scanners, thereby propelling the Document Scanner Market forward.

Technological Advancements in Scanning Solutions

The Document Scanner Market is benefiting from rapid technological advancements that enhance scanning capabilities. Innovations such as artificial intelligence, machine learning, and improved imaging technologies are transforming the functionality of document scanners. These advancements allow for faster processing speeds, higher resolution scans, and better integration with cloud services. Market analysis indicates that the introduction of smart scanners, which can automatically categorize and index documents, is likely to attract a broader customer base. As technology continues to evolve, the Document Scanner Market is expected to see increased competition and a wider array of products catering to diverse consumer needs.