Market Growth Projections

The Global Disulfurous Acid Market Industry is projected to experience substantial growth over the coming years. With a market size anticipated to reach 0.17 USD Billion in 2024 and potentially 0.3 USD Billion by 2035, the industry is on a promising trajectory. The compound annual growth rate of 5.46% from 2025 to 2035 suggests a robust expansion driven by various factors, including increased demand in chemical manufacturing, environmental regulations, and advancements in production technologies. These projections indicate a favorable outlook for stakeholders in the disulfurous acid market.

Rising Applications in Agriculture

The Global Disulfurous Acid Market Industry is witnessing an expansion in its applications within the agricultural sector. Disulfurous acid is utilized as a soil amendment and a component in fertilizers, enhancing soil quality and crop yield. As global food production demands escalate, the agricultural sector's reliance on effective soil treatment solutions is likely to drive the demand for disulfurous acid. This trend aligns with the market's projected growth, as agricultural practices increasingly incorporate disulfurous acid to improve sustainability and productivity.

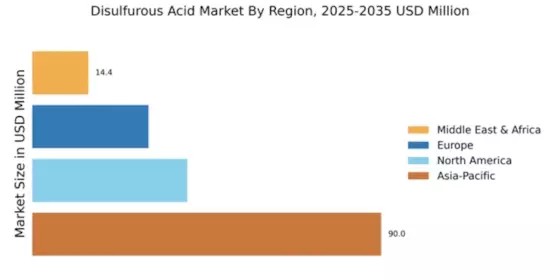

Emerging Markets and Economic Growth

Emerging markets are contributing to the growth of the Global Disulfurous Acid Market Industry as economic development accelerates. Countries in Asia-Pacific and Latin America are experiencing industrial growth, leading to increased demand for chemicals, including disulfurous acid. As these regions expand their manufacturing capabilities, the need for disulfurous acid in various applications is expected to rise. This trend may further bolster the market, with projections indicating a potential market size of 0.3 USD Billion by 2035, driven by the economic growth in these emerging markets.

Advancements in Production Technologies

Innovations in production technologies are poised to enhance the efficiency of disulfurous acid synthesis, thereby impacting the Global Disulfurous Acid Market Industry positively. Improved methods for synthesizing disulfurous acid not only reduce production costs but also minimize waste and energy consumption. As manufacturers adopt these advanced technologies, the availability of disulfurous acid is expected to increase, supporting its application across various sectors. This trend may contribute to a compound annual growth rate of 5.46% from 2025 to 2035, indicating a robust future for the market.

Growing Demand in Chemical Manufacturing

The Global Disulfurous Acid Market Industry is experiencing a notable increase in demand from the chemical manufacturing sector. Disulfurous acid serves as a crucial intermediate in the production of various chemicals, including sulfites and bisulfites, which are widely used in food preservation and water treatment processes. As industries seek to enhance their production efficiency and sustainability, the utilization of disulfurous acid is expected to rise. In 2024, the market is projected to reach 0.17 USD Billion, reflecting the growing reliance on this compound in chemical applications.

Environmental Regulations Favoring Sulfur Compounds

The Global Disulfurous Acid Market Industry is likely to benefit from stringent environmental regulations aimed at reducing sulfur emissions. Governments worldwide are implementing policies that promote the use of sulfur compounds, including disulfurous acid, as they are considered less harmful compared to other sulfur oxides. This regulatory landscape encourages industries to adopt disulfurous acid in their processes, potentially leading to a market growth trajectory that could see it reach 0.3 USD Billion by 2035. The alignment of disulfurous acid with environmental goals positions it favorably in the market.