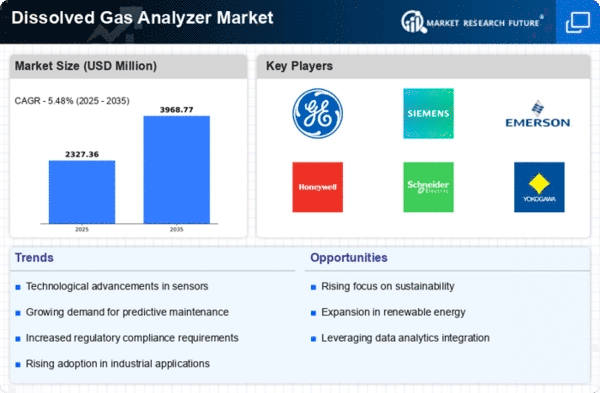

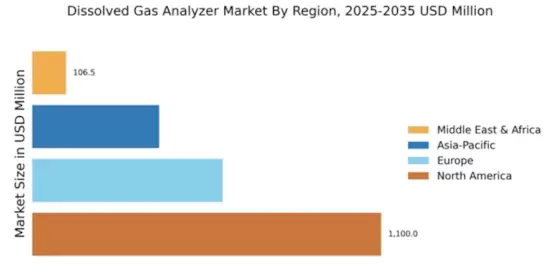

North America : Market Leader in Innovation

North America is poised to maintain its leadership in the Dissolved Gas Analyzer market, holding a significant market share of $1100.0M in 2024. The region's growth is driven by increasing demand for efficient monitoring solutions in power generation and oil & gas sectors, alongside stringent regulatory frameworks promoting safety and environmental standards. The adoption of advanced technologies and automation further fuels market expansion. The United States stands out as the leading country, hosting major players like General Electric and Emerson Electric. The competitive landscape is characterized by innovation and strategic partnerships among key companies, including Honeywell and Schneider Electric. This dynamic environment fosters continuous advancements in dissolved gas analysis technologies, ensuring that North America remains at the forefront of the market.

Europe : Emerging Regulatory Frameworks

Europe is witnessing a robust growth trajectory in the Dissolved Gas Analyzer market, with a market size of $600.0M. The region's expansion is largely attributed to stringent environmental regulations and the increasing need for compliance in industrial operations. Countries are investing in advanced monitoring technologies to meet these regulatory demands, driving the adoption of dissolved gas analyzers across various sectors. Germany and France are leading the charge, with significant contributions from companies like Siemens and Schneider Electric. The competitive landscape is marked by a focus on innovation and sustainability, as firms strive to enhance their product offerings. The presence of established players and a growing emphasis on environmental compliance are key factors propelling market growth in Europe.

Asia-Pacific : Rapid Industrialization and Growth

Asia-Pacific is emerging as a significant player in the Dissolved Gas Analyzer market, with a market size of $400.0M. The region's growth is driven by rapid industrialization, particularly in countries like China and India, where the demand for efficient monitoring solutions is surging. Additionally, government initiatives aimed at improving energy efficiency and safety standards are catalyzing market expansion in this region. China is the dominant country in this market, supported by a growing number of local manufacturers and international players like Yokogawa Electric. The competitive landscape is evolving, with companies focusing on technological advancements and cost-effective solutions to capture market share. As the region continues to industrialize, the demand for dissolved gas analyzers is expected to rise significantly, presenting lucrative opportunities for stakeholders.

Middle East and Africa : Resource-Rich Yet Challenging Market

The Middle East and Africa region is gradually developing its Dissolved Gas Analyzer market, currently valued at $106.45M. The growth is primarily driven by economic diversification efforts in oil-rich countries, where there is a push towards adopting advanced monitoring technologies. Regulatory frameworks are evolving, encouraging industries to invest in safety and environmental compliance, which is essential for sustainable growth in the region. Countries like the UAE and South Africa are leading the market, with a growing presence of international players such as Endress+Hauser. The competitive landscape is characterized by a mix of local and global companies striving to meet the unique demands of the region. As industries continue to modernize, the demand for dissolved gas analyzers is expected to increase, providing opportunities for innovation and investment.