Market Trends

Key Emerging Trends in the Disinfectant Chemicals Market

Consumers are involved now in the walk of chemical-free disinfectants since the risk of chemical-based disinfectants is the issue. Chemical-based disinfectants mainly fall on respiratory organs in human. Take for instance the case of the excessive use of hand sanitizers which contain alcohol, chloroxylenol, chlorhexidine, and triclosan among other chemicals that can make one’s skin dry over time and irritate the skin as a result. The intake of damaging substances temporarily interferes with the skin's natural moisture barrier, making it more prone to bacteria.

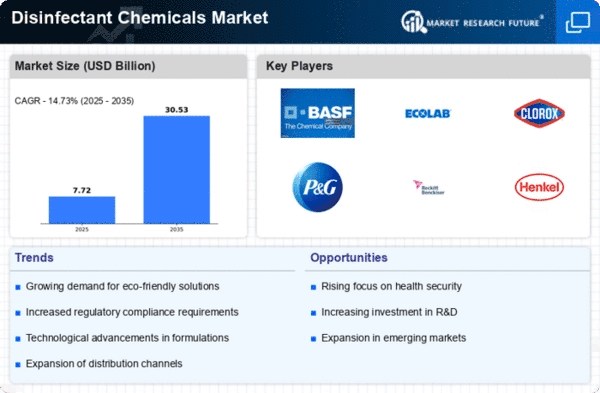

The market of Disinfectant Chemicals is the present moment undergoing notable trends, as the demand for such products and application fields crosses many industries, especially the healthcare industry as well as sanitation. The controlling spread of infectious diseases and ensuring hygiene in different settings depends to a greater extent on sanitizing chemical disinfectants. A notable case in current market is that disinfectant chemicals has a great demand during global health as result of COVID-19 pandemic. With the expertise centered on surface sterilization and the rise of demand for appropriately functioning disinfectant chemicals there emerged a situation in which public spaces, healthcare facilities, and households are being secured from the risks of infections.

On the other hand, the healthcare sector remains as one of the propelling forces of the trends in disinfectant chemicals sales market. Hospitals, clinics, and other points of healthcare service need to uphold rigorous disinfection strategies in order to stop the ongoing spread of infections. The continuous increases in the requirement for infection prevention and the control practices in healthcare facilities create the demand on the disinfectant chemicals with wide-spectrum antimicrobial activity. This movement plays a crucial role in the provision of safe and sterile environment in hospitals all around.

Sustainable environmental practices gain more relevance in terms of recent trends in the market for disinfecting chemicals. The exploitation of eco-friendly and degradable formulations for the disinfection products has been thriving as an alternative to the synthetically manufactured chemical formulations. In response to this trend, manufacturers are introducing cleaning and sanitation products with better environmental profile. It is in line with a worldwide initiative aimed at sustainable practices and green product launches. This is in line with industrial wastewater treatment processes to minimize the environmental footprint of disinfection of effluents.

On the other hand, food and drinks in this industry are at the center of the changes that happen in disinfectant chemicals market. One of the main job of the disinfecting process is to guarantee sanitation of foodstuffs and to guarantee their quality. The growing demand for stringent hygiene standards and regulations in the food industry is increasing the need for disinfectant chemicals which accommodate pathogenic resistance and comply with the food safety procedure and regulations. As a result of this requirement, the major part of the water used by the industry serving the food sector has to be recycled and reused.

Leave a Comment