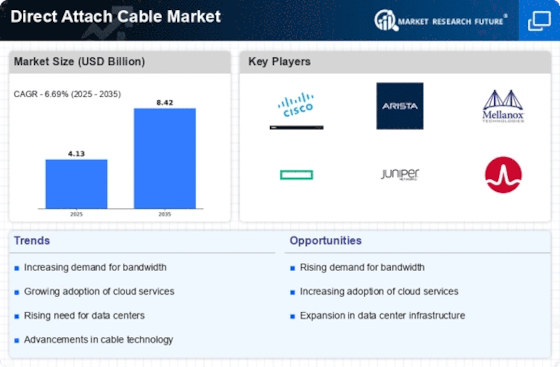

Rising Data Center Investments

The Direct Attach Cable Market is experiencing a surge in investments directed towards data centers. As organizations increasingly rely on cloud computing and data storage solutions, the demand for efficient interconnectivity solutions rises. In 2025, the data center market is projected to reach a valuation of approximately 200 billion dollars, which directly influences the Direct Attach Cable Market. These cables provide a cost-effective and high-performance solution for connecting servers and switches within data centers, thereby enhancing overall operational efficiency. The trend towards hyper-converged infrastructure further propels the need for reliable and high-speed connections, making direct attach cables a preferred choice for many data center operators.

Growing Adoption of 5G Technology

The Direct Attach Cable Market is poised to benefit from the rapid rollout of 5G technology. As telecommunications companies invest heavily in 5G infrastructure, the demand for high-speed data transmission increases. Direct attach cables, known for their low latency and high bandwidth capabilities, are essential for connecting 5G base stations and core networks. The anticipated growth in 5G subscriptions, expected to surpass 1 billion by the end of 2025, indicates a substantial market opportunity for direct attach cables. This technology not only enhances mobile connectivity but also supports the proliferation of IoT devices, further driving the demand for efficient cabling solutions.

Increased Focus on Network Security

The Direct Attach Cable Market is also influenced by the heightened focus on network security. As cyber threats become more sophisticated, organizations are investing in secure networking solutions. Direct attach cables, which offer a direct connection between devices, reduce the risk of data interception compared to wireless solutions. The increasing implementation of stringent data protection regulations further drives the demand for secure cabling options. In 2025, The Direct Attach Cable Market is projected to reach 300 billion dollars, highlighting the importance of secure infrastructure. This trend indicates that direct attach cables will be integral to organizations' efforts to enhance their network security posture.

Shift Towards Cloud-Based Solutions

The Direct Attach Cable Market is significantly influenced by the ongoing shift towards cloud-based solutions. As businesses migrate their operations to the cloud, the need for robust and reliable connectivity solutions becomes paramount. In 2025, the cloud services market is projected to exceed 500 billion dollars, creating a substantial demand for direct attach cables that facilitate seamless data transfer between cloud servers and user devices. These cables offer a straightforward and efficient means of establishing connections, which is crucial for maintaining high performance in cloud environments. The increasing reliance on Software as a Service (SaaS) applications further underscores the importance of direct attach cables in ensuring uninterrupted service delivery.

Emergence of Artificial Intelligence Applications

The Direct Attach Cable Market is likely to see growth driven by the emergence of artificial intelligence (AI) applications. As organizations integrate AI into their operations, the need for high-speed data processing and transfer becomes critical. Direct attach cables provide the necessary bandwidth and low latency required for AI workloads, which often involve large datasets. The AI market is expected to reach approximately 190 billion dollars by 2025, indicating a growing reliance on efficient data transfer solutions. This trend suggests that direct attach cables will play a vital role in supporting the infrastructure needed for AI technologies, thereby enhancing their performance and scalability.