Market Growth Projections

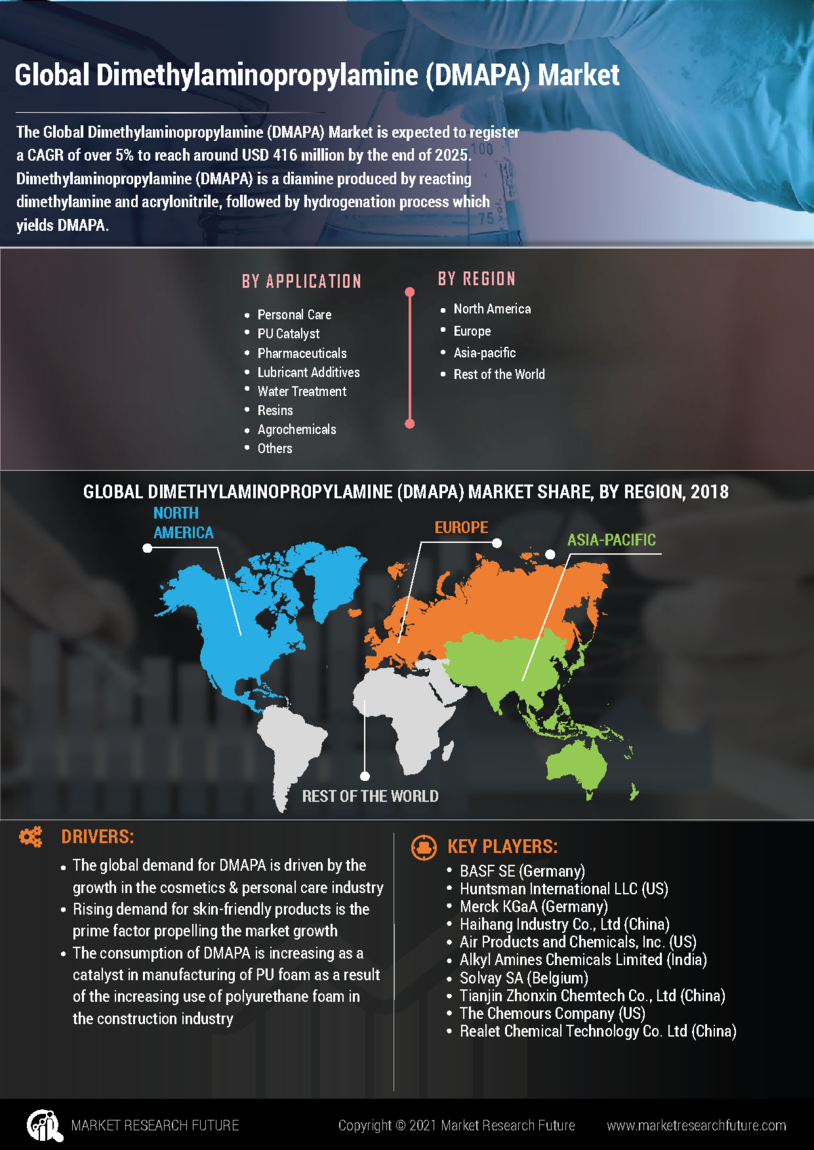

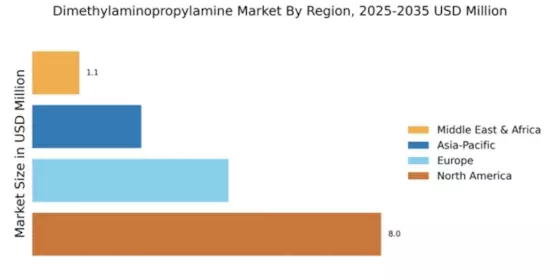

The Global Dimethylaminopropylamine Market (DMAPA) Market Industry is projected to experience substantial growth over the coming years. With an estimated market value of 413.4 USD Million in 2024, it is anticipated to reach 664.9 USD Million by 2035. This growth reflects a compound annual growth rate (CAGR) of 4.41% from 2025 to 2035, indicating a robust market trajectory. The increasing demand across various sectors, including personal care, textiles, and adhesives, underpins this expansion. As industries continue to seek high-performance chemical solutions, DMAPA's versatility positions it favorably within the global market landscape.

Regulatory Support for Chemical Safety

The Global Dimethylaminopropylamine Market (DMAPA) Market Industry is positively influenced by regulatory support for chemical safety. Governments worldwide are implementing stringent regulations to ensure the safe use of chemicals in various applications. This regulatory framework encourages manufacturers to adopt safer alternatives, positioning DMAPA as a viable option due to its favorable safety profile. As industries comply with these regulations, the demand for DMAPA is expected to rise, particularly in sectors such as pharmaceuticals and personal care. The proactive stance of regulatory bodies may enhance market confidence, leading to increased investments in DMAPA-related products.

Growth in Adhesives and Sealants Sector

The Global Dimethylaminopropylamine Market (DMAPA) Market Industry is bolstered by the expanding adhesives and sealants sector. DMAPA is utilized as a curing agent in epoxy resins, which are increasingly favored in construction and automotive applications due to their superior bonding properties. The demand for high-performance adhesives is anticipated to rise, driven by infrastructure development and automotive manufacturing. This sector's growth contributes to the overall market expansion, with a projected compound annual growth rate (CAGR) of 4.41% from 2025 to 2035. As industries seek durable and efficient bonding solutions, DMAPA's role becomes increasingly pivotal.

Rising Demand in Personal Care Products

The Global Dimethylaminopropylamine Market (DMAPA) Market Industry experiences a notable surge in demand driven by its application in personal care products. DMAPA serves as a key ingredient in hair care formulations, enhancing product performance and stability. As consumers increasingly prioritize high-quality personal care items, the market for DMAPA is projected to grow significantly. In 2024, the market value is estimated at 413.4 USD Million, reflecting a robust consumer trend towards premium personal care solutions. This growth trajectory is likely to continue, with the market expected to reach 664.9 USD Million by 2035, indicating a sustained interest in DMAPA-based formulations.

Increasing Applications in Textile Industry

The Global Dimethylaminopropylamine Market (DMAPA) Market Industry is witnessing growth due to its diverse applications in the textile industry. DMAPA is employed in the production of textile chemicals, particularly in dyeing and finishing processes, enhancing color retention and fabric durability. As the global textile market expands, driven by rising consumer demand for innovative fabrics, the need for effective chemical agents like DMAPA is likely to increase. This trend suggests a potential for market growth, as manufacturers seek to improve product quality and sustainability. The integration of DMAPA in textile applications could further solidify its market position.

Advancements in Chemical Manufacturing Processes

The Global Dimethylaminopropylamine Market (DMAPA) Market Industry benefits from advancements in chemical manufacturing processes. Innovations in production techniques enhance the efficiency and sustainability of DMAPA synthesis, reducing costs and environmental impact. As manufacturers adopt greener practices, the appeal of DMAPA as a versatile chemical compound increases. This shift towards sustainable manufacturing aligns with global trends emphasizing environmental responsibility. Consequently, the market is likely to see increased adoption of DMAPA across various industries, further driving its growth. The emphasis on sustainable practices may also attract new entrants into the market, fostering competition and innovation.