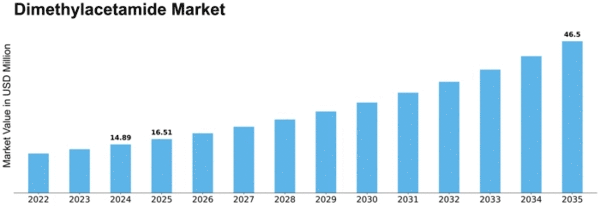

Dimethylacetamide Size

Dimethylacetamide Market Growth Projections and Opportunities

The Dimethylacetamide (DMAc) Market is influenced by a multitude of factors that collectively shape its growth trajectory, demand dynamics, and overall competitiveness. These factors encompass both industry-specific considerations and broader economic and environmental influences. Here's a succinct breakdown of key market factors defining the landscape of the Dimethylacetamide Market:

Versatile Industrial Solvent:

Dimethylacetamide serves as a versatile industrial solvent, finding applications in the production of pharmaceuticals, fibers, and resins.

Its excellent solvency properties make DMAc indispensable in various industrial processes, contributing to its widespread use.

Pharmaceutical and Chemical Manufacturing:

The pharmaceutical industry heavily relies on DMAc as a solvent in the synthesis of active pharmaceutical ingredients (APIs) and pharmaceutical formulations.

Additionally, DMAc is used in the production of specialty chemicals, dyes, and agrochemicals, contributing to its demand in chemical manufacturing.

Polymer Processing and Fiber Production:

DMAc plays a crucial role in polymer processing, particularly in the production of high-performance polymers and fibers such as aramid and spandex.

The demand for advanced materials in sectors like textiles and automotive drives the use of DMAc in polymer production.

Asia-Pacific Dominance:

The Asia-Pacific region, particularly China, stands as a major consumer and producer of DMAc, owing to its robust manufacturing base and industrial activities.

The region's dominance in the global DMAc market is influenced by its position as a manufacturing hub for various industries.

Textile Industry Applications:

DMAc is extensively used in the textile industry for the production of specialty fibers, including spandex and aramid fibers.

The demand for innovative and high-performance textiles, especially in sportswear and activewear, contributes to the use of DMAc in textile applications.

Electronics and Industrial Coatings:

DMAc is employed in the electronics industry for the production of coatings and films, offering properties like high boiling points and excellent film-forming characteristics.

Its use in industrial coatings and electronic components contributes to the demand for DMAc in the electronics sector.

Evolving Regulatory Landscape:

The DMAc market is subject to regulatory considerations, particularly regarding its classification as a hazardous substance and potential health and environmental concerns.

Evolving regulations impact the market as manufacturers adhere to compliance standards and explore alternative solvents.

Technological Advances in Solvent Alternatives:

Ongoing research and development efforts focus on finding alternative solvents with lower environmental impact and improved safety profiles.

Technological advancements and innovations in solvent alternatives may influence the DMAc market, particularly in response to regulatory pressures.

Demand for Eco-Friendly Solvents:

Growing environmental awareness prompts a shift towards the use of eco-friendly and green solvents in various industries.

Manufacturers explore alternative solvents that align with sustainability goals, impacting the demand for traditional solvents like DMAc.

Fluctuations in Raw Material Prices:

The DMAc market is influenced by the prices of raw materials, particularly acetic acid and dimethylamine.

Fluctuations in raw material prices impact the production costs and pricing strategies of DMAc manufacturers.

Health and Safety Concerns:

Health and safety considerations related to the handling and exposure to DMAc influence its use in industrial settings.

Manufacturers and end-users prioritize safety measures and explore ways to mitigate potential health risks associated with DMAc.

Global Economic Trends:

Economic factors, including GDP growth, industrial output, and trade dynamics, impact the overall demand for DMAc in key markets.

Economic trends influence investment decisions, production activities, and consumer spending patterns, shaping the DMAc market's trajectory.

Leave a Comment