Top Industry Leaders in the Digital Signage Market

The Competitive Landscape of the Digital Signage Market

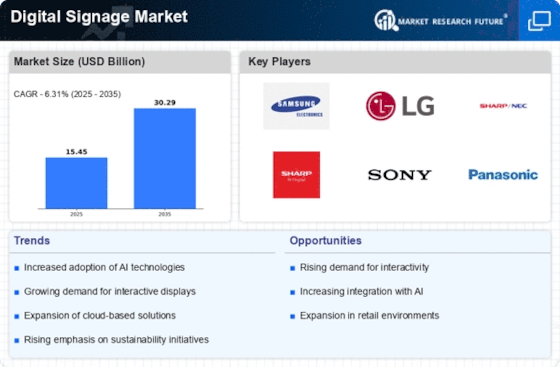

The digital signage market is no longer a niche corner of advertising; it has blossomed into a vibrant arena where captivating visuals dance with cutting-edge technology, captivating audiences and influencing purchasing decisions. This dynamic space holds opportunities for established tech giants, agile startups, and niche innovators, all vying for a slice of the pie. Understanding the competitive landscape, adopted strategies, key players, and emerging trends is crucial for success in this ever-evolving realm.

Some of the Digital Signage companies listed below:

- Redbox Automated Retail LLC

- LG Electronics

- Daktronics

- Samsung Electronics Co. Ltd

- Barco

- Panasonic Corporation

- Sony Corporation

- NEC Corporation

- Goodview Company

- Leyard

Strategies Adopted by Leaders:

- Embracing the Cloud and Software-as-a-Service (SaaS): Cloud-based content management platforms offer increased accessibility, scalability, and cost-efficiency, particularly for smaller businesses.

- Investing in User Experience and Engagement: Implementing interactive elements, personalized content, and data-driven insights to deliver engaging experiences that resonate with audiences.

- Partnerships and Ecosystem Building: Collaborating with content providers, digital agencies, or network operators expands reach, offers bundled solutions, and strengthens brand offerings.

- Focus on Data Analytics and Measurement: Leveraging data analytics to measure campaign performance, understand audience behavior, and optimize content for maximum impact.

- Sustainability and Eco-Friendly Practices: Utilizing energy-efficient displays, incorporating recycled materials, and offering long-lasting solutions are becoming increasingly important considerations.

Factors for Market Share Analysis:

- Product Portfolio and Innovation: The range and sophistication of displays offered, from immersive video walls to interactive touchscreens, significantly impact a vendor's appeal. Offering cutting-edge features like HDR (High Dynamic Range) support, facial recognition, and gesture control can be significant differentiators.

- Target Market Focus: Catering to specific segments like retail stores, corporate offices, hospitality venues, or transportation hubs requires customized solutions and content strategies. Addressing the unique needs of each segment can solidify market share within that niche.

- Software and Content Management Solutions: Robust software platforms for content creation, scheduling, and remote management are key for efficient signage operations. Offering user-friendly interfaces and content libraries further enhances appeal.

- Scalability and Connectivity: Seamless integration with existing infrastructure, network compatibility, and the ability to scale deployments easily are critical for larger organizations and multi-location settings.

- Pricing Strategy and Value Proposition: Striking the right balance between affordability and feature depth is essential. Offering flexible pricing models like leasing, subscriptions, or service contracts can broaden appeal and increase penetration.

New and Emerging Companies:

- Niche-Focused Startups: Companies like Barco ClickShare and Mvix specialize in specific applications like wireless presentation systems or healthcare-focused digital signage, offering tailored solutions catering to unique needs.

- Software and Data Analytics Specialists: Companies like STRATACACHE and Rise Vision focus on software platforms and data-driven insights, enhancing content effectiveness and audience engagement.

- Interactive and Experiential Signage Startups: Companies like OutOfHome Interactive and Ximble develop interactive displays, projection mapping solutions, and immersive experiences, pushing the boundaries of engagement and personalization.

Latest Company Updates:

November 2023- Sharp/NEC Display Solutions & SpinetiX, digital signage firm have joined hands recently for a digital signage solution which is ready to use. This will chiefly prioritize on scalability, accessibility, and security. The solution will leverage the SpinetiX DSOS digital signage operating system that is built on Sharp/NEC displays with integrated Intel SDM. In fact, the core value to offer clients with the utmost support technically and commercially is key to the strategic merger. With the digital signage landscape continuing to expand, this partnership will allow them in responding more efficiently to the frequent demands of their customers.

October 2023- BE-Tech AV Mounts, a leading digital signage installation solution provider has lately unveiled the news of its collaboration with Network One Distribution (NOD), a Romania based distributor. NOD is amid the selected distributors within Romania having a clear focus on the channel along with having a dedicated pro-AV department reaching to every key system integrator in the country. The investments within the country are rapidly developing and with proven potential for B-Tech product range, they are convinced of the current add on to their distribution network will be an immense success.

October 2023- Tata Tea Gold had recently launched a 3D digital signage campaign. Made to correspond with Durga Puja celebration, the campaign included tributes to the Bengali culture. This ad campaign had been made in association with Laqshya Media. By leveraging advanced technology for modern storytelling, they endeavoured to celebrate the acclaimed handlooms of West Bengal, creating resonance with their consumers.