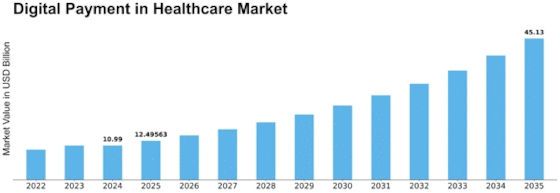

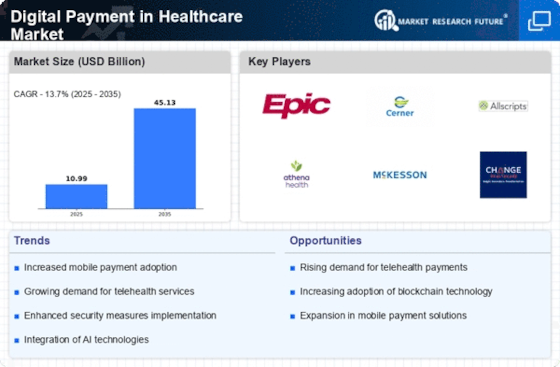

Digital Payment Healthcare Size

Digital Payment Healthcare Market Growth Projections and Opportunities

Recent years have seen a radical change in the digital payment environment in the healthcare industry, fueled by several market forces that together influence its future. A significant contributing aspect is the increasing focus in the healthcare sector on increasing productivity and cutting expenses associated with operations. Digital payment solutions provide a practical way for healthcare providers to accomplish their goals of improving patient experiences and streamlining their operations. Transaction times are sped up and the administrative load related to conventional payment methods is reduced when digital payment systems are integrated. Furthermore, the spread of digital payments in the healthcare industry is greatly aided by the growing use of mobile technologies. Since smartphones are owned by most people on the planet, the ease of use and accessibility provided by mobile platforms greatly aid in the uptake of solutions for digital payments. User-friendly mobile applications allow patients to easily schedule appointments, make payments, and obtain billing information, thereby improving total patient engagement. The growth of telehealth services, which allows for digital payments to conduct remote visits and transactions and promote a more affordable and patient-centered healthcare experience, further supports this trend. Concerns about security and the requirement for strict data protection constitute yet another important market element driving the widespread utilization of digital payments in the healthcare industry. Digital payment systems must have strong security measures in place as the sector struggles to protect sensitive patient data. Encryption technology, safe authentication techniques, and regulatory compliance all work together to protect patient privacy and financial transactions while fostering trust between healthcare professionals and patients. A favorable climate for medical professionals to use these technologies is created by financial incentives, tax breaks, and regulations that support the compatibility and uniformity of digital payment systems. These kinds of programs encourage creativity and help modernize the healthcare system. Key elements driving the expansion of digital payments in the medical industry include scalability and integration with current healthcare systems. Digital payment methods that interface with other healthcare systems of record and electronic health records effortlessly give healthcare providers a competitive advantage as they search for seamless interoperability across multiple platforms and systems. The total effectiveness of healthcare operations is improved, errors are decreased, and administrative procedures are streamlined by this integration.

Leave a Comment