Emerging Applications in Material Science

The IR Spectroscopy Market is also benefiting from emerging applications in material science, where the technology is utilized to analyze polymers, composites, and nanomaterials. The ability to characterize molecular structures and interactions at a microscopic level is crucial for the development of advanced materials. Recent studies suggest that the material science segment is poised for growth, with an anticipated CAGR of 5.5% over the next five years. This growth is driven by the increasing demand for innovative materials in industries such as aerospace, automotive, and electronics. As researchers continue to explore the potential of IR spectroscopy in material characterization, its relevance in this field is likely to expand, offering new insights into material properties and performance.

Rising Demand in Environmental Monitoring

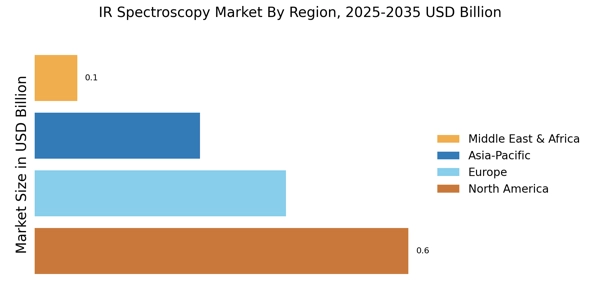

The IR Spectroscopy Market is witnessing a notable increase in demand for environmental monitoring applications. As concerns regarding air and water quality intensify, the need for reliable analytical methods to detect pollutants and hazardous substances becomes paramount. IR spectroscopy offers a rapid and effective means of identifying various environmental contaminants, including volatile organic compounds (VOCs) and greenhouse gases. Recent data indicates that the environmental monitoring segment is expected to grow at a CAGR of 6% over the next five years, driven by regulatory pressures and public awareness. This growth is indicative of the technology's potential to contribute to environmental sustainability efforts, making it a vital tool for researchers and regulatory agencies alike.

Technological Advancements in IR Spectroscopy

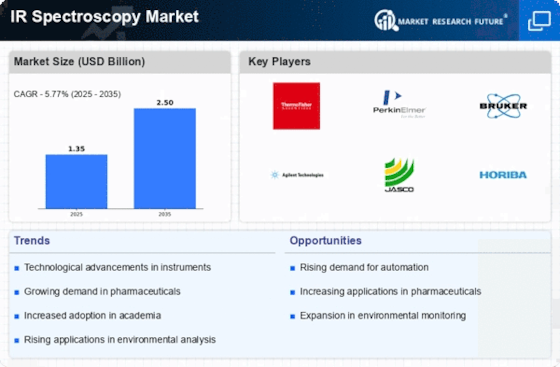

The IR Spectroscopy Market is experiencing a surge in technological advancements that enhance the capabilities and applications of infrared spectroscopy. Innovations such as Fourier Transform Infrared (FTIR) spectroscopy and portable IR spectrometers are becoming increasingly prevalent. These advancements allow for more precise measurements and broader applications across various sectors, including pharmaceuticals, environmental monitoring, and food safety. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 7.5% from 2025 to 2030, driven by the demand for advanced analytical techniques. Furthermore, the integration of artificial intelligence and machine learning into IR spectroscopy systems is likely to improve data analysis and interpretation, making the technology more accessible and efficient for end-users.

Increased Adoption in Pharmaceutical Applications

The pharmaceutical sector is a key driver of the IR Spectroscopy Market, as the technology is widely utilized for drug formulation and quality control. The ability of IR spectroscopy to provide rapid and non-destructive analysis of chemical compounds makes it indispensable in this field. According to recent estimates, the pharmaceutical segment accounts for nearly 30% of the total market share, reflecting a growing reliance on IR spectroscopy for regulatory compliance and research purposes. The increasing focus on drug safety and efficacy is likely to propel further adoption of IR spectroscopy techniques, as they facilitate the identification of active ingredients and impurities in pharmaceutical products. This trend underscores the importance of IR spectroscopy in ensuring the integrity of pharmaceutical manufacturing processes.

Growing Interest in Food Safety and Quality Control

The food and beverage industry is increasingly recognizing the value of the IR Spectroscopy Market for ensuring food safety and quality control. The technology enables rapid analysis of food products, allowing for the detection of adulterants and the assessment of nutritional content. With The IR Spectroscopy Market projected to reach USD 20 billion by 2027, the role of IR spectroscopy in this sector is becoming more pronounced. The ability to perform non-destructive testing and real-time analysis positions IR spectroscopy as a preferred method for food quality assessment. As consumer awareness regarding food safety rises, the demand for reliable analytical techniques like IR spectroscopy is likely to expand, further solidifying its position in the food industry.