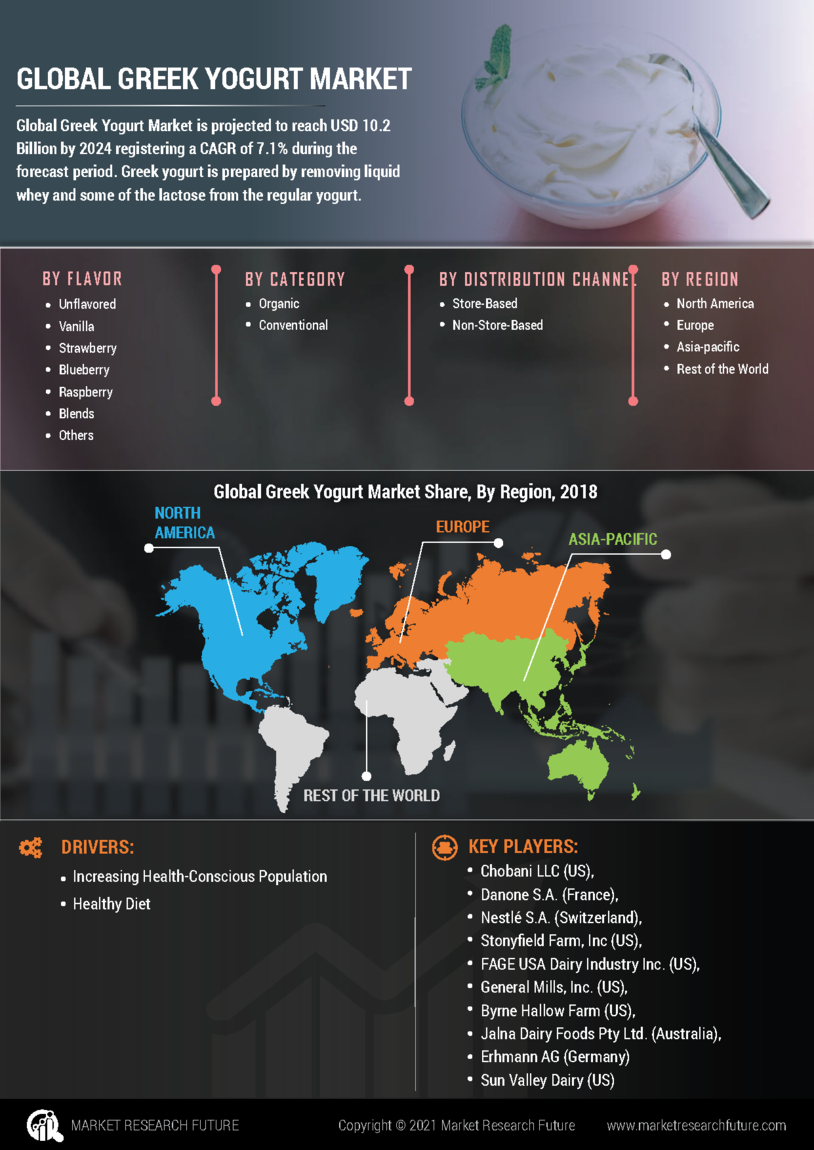

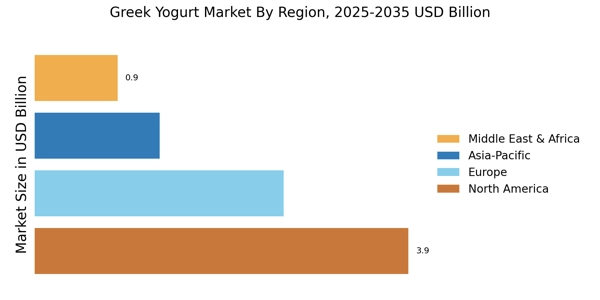

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American Greek Yogurt market accounted for USD 3.7 billion in 2022 and will likely exhibit a significant CAGR growth over the study period. Greek yogurt is becoming increasingly popular throughout the region as a healthier alternative to ice cream, particularly among children and young adults, as obesity rates in developed nations like Canada, the U.S., and Mexico continue to rise.

Organic greek yogurt consumption is increasing in the North American market due to its probiotic product line and ability to enhance metabolism, improve digestion, and support the immune system. Desserts made from greek yogurt are also popular in the region. It is available in various flavors, including fruit yogurt, organic yogurt, and drinkable yogurt, which customers receive well. Yogurt products, for example, are popular in the United States and are expected to remain this way throughout the forecast period, owing to their health benefits.

Further, the major countries studied in the global market report are the U.S., Germany, Canada, France, the UK, Spain, Italy, Japan, India, Australia, China, South Korea, and Brazil.

The European greek yogurt market accounts for the second-largest market share. Several untapped opportunities for the Greek yogurt industry drive the regional market. Additionally, the developing Eastern Europe region is anticipated to outperform Western European markets, where dairy sales suffer due to the growing acceptance of dairy-free alternatives. Several European yogurt producers are modernizing their plants with automated fresh milk production lines. General Mills also sold the Yoplait business in Europe in 2021. Sodiaal, a dairy cooperative, purchased a 51% stake in the company.

Moreover, stringent health and fitness regulations imposed by governments in various European countries drive the market demand for Greek yogurt in this region. Further, the German market of greek yogurt held the largest market share, and the UK greek yogurt industry was the fastest-growing market in the European region.

The Asia-Pacific market of greek yogurt is expected to grow at the fastest CAGR from 2022 to 2030, owing to rising demand for probiotics in the region, particularly in China, Japan, and India. In China, approximately 83% of the total population consumes organic yogurt. These people consume organic greek yogurt as it contains probiotics. The rising consumption of organic yogurt as a snack in China propels the overall market expansion. Rising disposable income in the Asia Pacific developing countries has increased spending on premium food items, which is expected to propel the regional maret of greek yogurt forward.

Moreover, China’s greek yogurt industry held the largest market share, and the Indian greek yogurt market was the fastest-growing market in the Asia-Pacific region.