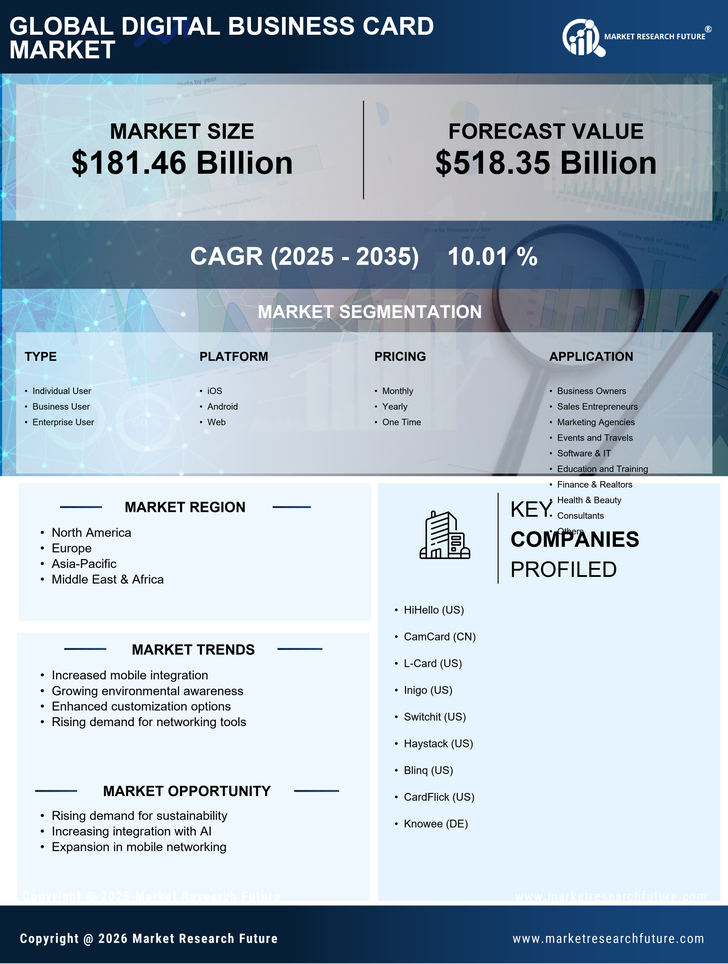

North America : Digital Innovation Leader

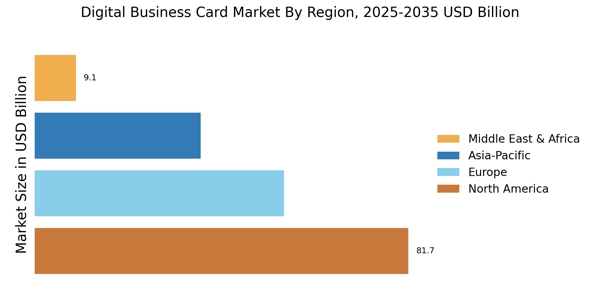

North America is the largest market for digital business cards, holding approximately 45% of the global share. The region's growth is driven by high smartphone penetration, increasing adoption of contactless technologies, and a strong emphasis on networking in business environments. Regulatory support for digital solutions further catalyzes market expansion, with initiatives promoting digital transformation across industries. The United States leads the market, with key players like HiHello, L-Card, and Inigo dominating the landscape. Canada follows as the second-largest market, contributing around 15% to the overall share. The competitive environment is characterized by innovation and a focus on user-friendly solutions, with companies continuously enhancing features to meet evolving consumer needs.

The US digital business card market dominates the North American region, driven by strong adoption of contactless networking and digital transformation initiatives. The Canada digital business card market continues to expand steadily, supported by growing adoption among enterprises and technology startups.

Europe : Emerging Digital Solutions Hub

Europe is witnessing significant growth in the digital business card market, accounting for approximately 30% of the global share. The rise in remote working and digital networking has fueled demand for innovative solutions. Regulatory frameworks promoting digital identity and data protection are also key drivers, enhancing consumer trust and adoption of digital business cards across the region. Germany and the UK are the leading countries in this market, with Germany holding a substantial share due to its robust tech ecosystem. Companies like Knowee are making strides in the market, while competition is intensifying with new entrants focusing on sustainability and user experience. The European market is characterized by a diverse range of offerings tailored to various professional needs.

The UK digital business card market is witnessing strong growth due to rising remote working trends and digital identity adoption. The Germany digital business card market benefits from a robust technology ecosystem and increasing emphasis on digital business networking. The France digital business card market is gaining traction as enterprises increasingly adopt paperless and sustainable networking solutions.

Asia-Pacific : Rapidly Growing Digital Market

Asia-Pacific is rapidly emerging as a significant player in the digital business card market, holding around 20% of the global share. The region's growth is driven by increasing smartphone usage, urbanization, and a growing emphasis on digital solutions in business practices. Countries are also implementing supportive regulations to foster digital innovation, enhancing the market's potential. China and India are the leading countries in this region, with China being the largest market due to its vast population and tech-savvy consumers. Key players like CamCard are capitalizing on this trend, while local startups are entering the market with innovative solutions. The competitive landscape is vibrant, with a focus on integrating advanced technologies like AI and AR to enhance user experience.

The China digital business card market represents one of the largest opportunities in Asia-Pacific due to its vast population and high smartphone penetration. The India digital business card market is expanding rapidly, supported by growing digitalization and increasing adoption among small and medium enterprises. The Japan digital business card market is driven by strong enterprise adoption and a culture of technology-enabled business networking. The APAC digital business card market is emerging as a high-growth region, driven by smartphone adoption, urbanization, and expanding digital ecosystems.

Middle East and Africa : Emerging Digital Frontier

The Middle East and Africa region is gradually emerging in the digital business card market, currently holding about 5% of the global share. The growth is driven by increasing smartphone penetration and a shift towards digital solutions in business networking. Governments are also recognizing the importance of digital transformation, implementing policies to support tech innovation and entrepreneurship in the region.

Countries like South Africa and the UAE are leading the charge, with a growing number of startups entering the digital business card space. The competitive landscape is evolving, with local players focusing on customization and user engagement. As the region continues to develop its digital infrastructure, the potential for growth in this market is significant.The GCC digital business card market is gradually expanding as enterprises in the UAE and Saudi Arabia accelerate digital transformation initiatives.