Market Growth Projections

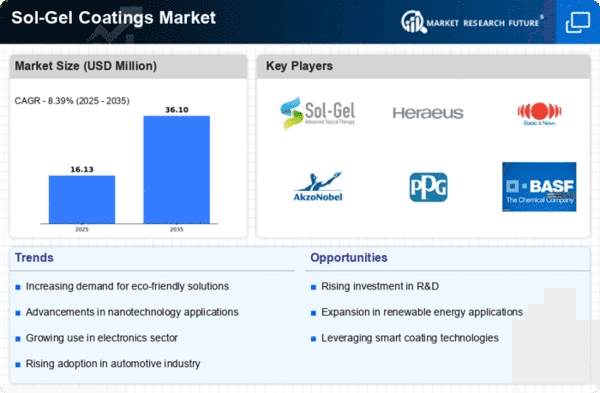

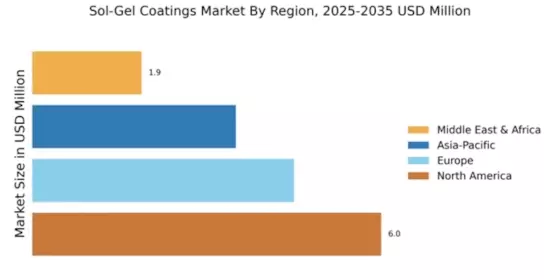

The Global Sol-Gel Coatings Market Industry is poised for substantial growth, with projections indicating a market size of 2500 USD Million in 2024 and an expected increase to 5000 USD Million by 2035. This growth trajectory suggests a robust demand for sol-gel coatings across various industries, driven by technological advancements and increasing applications. The market is likely to experience a compound annual growth rate of 6.5% from 2025 to 2035, reflecting the ongoing innovation and adoption of sol-gel technologies in diverse sectors.

Advancements in Nanotechnology

Nanotechnology is revolutionizing the Global Sol-Gel Coatings Market Industry by enhancing the properties of coatings. The incorporation of nanoparticles into sol-gel formulations can improve mechanical strength, thermal stability, and corrosion resistance. This technological advancement is particularly beneficial in industries such as electronics and aerospace, where performance is critical. As manufacturers continue to explore innovative applications, the demand for high-performance sol-gel coatings is expected to rise. The market is anticipated to grow at a CAGR of 6.5% from 2025 to 2035, indicating a robust future driven by technological progress.

Rising Applications in Electronics

The electronics sector is increasingly adopting sol-gel coatings due to their superior insulating and protective properties. These coatings are utilized in various applications, including circuit boards and optical devices, where durability and performance are paramount. The Global Sol-Gel Coatings Market Industry is witnessing a surge in demand as manufacturers seek reliable solutions to enhance product longevity. With the market projected to reach 5000 USD Million by 2035, the electronics industry plays a crucial role in driving growth and innovation within the sol-gel coatings segment.

Expansion of the Construction Sector

The construction sector's expansion is significantly influencing the Global Sol-Gel Coatings Market Industry. As urbanization continues to rise globally, there is an increasing demand for durable and aesthetically pleasing coatings for buildings and infrastructure. Sol-gel coatings offer excellent adhesion, weather resistance, and aesthetic versatility, making them ideal for various applications in construction. This trend is likely to drive market growth, as the construction industry seeks innovative solutions to enhance the longevity and appearance of structures. The anticipated growth in this sector further supports the overall expansion of the sol-gel coatings market.

Growing Demand for Eco-Friendly Coatings

The increasing emphasis on sustainability is driving the Global Sol-Gel Coatings Market Industry towards eco-friendly solutions. As industries seek to reduce their environmental footprint, sol-gel coatings, which are often derived from non-toxic materials, are gaining traction. These coatings not only provide excellent performance but also align with regulatory requirements aimed at minimizing hazardous substances. This trend is evident in sectors such as automotive and construction, where companies are adopting greener alternatives. The Global Sol-Gel Coatings Market is projected to reach 2500 USD Million in 2024, reflecting a significant shift towards sustainable practices.

Increased Investment in Research and Development

Investment in research and development is a key driver of innovation within the Global Sol-Gel Coatings Market Industry. Companies are focusing on developing new formulations that offer enhanced properties and broader applications. This commitment to R&D is evident in collaborations between academic institutions and industry players, leading to breakthroughs in sol-gel technology. As a result, the market is likely to expand, with new products entering the market that cater to diverse needs. This focus on innovation is expected to contribute to the overall growth of the market in the coming years.