Diesel Generator Size

Market Size Snapshot

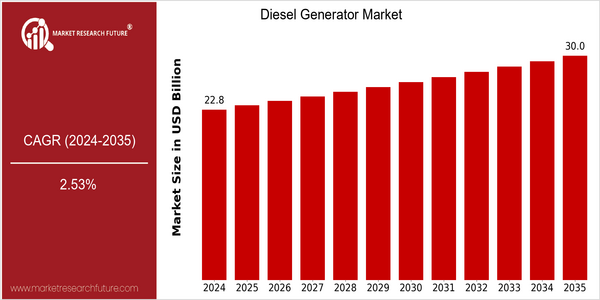

| Year | Value |

|---|---|

| 2024 | USD 22.77 Billion |

| 2035 | USD 30.0 Billion |

| CAGR (2025-2035) | 2.53 % |

Note – Market size depicts the revenue generated over the financial year

The diesel-engine market will grow steadily, and the value of the global market in 2024 is estimated at $ 22.77 billion, which will increase to $ 30 billion in 2035. The CAGR from 2025 to 2035 is a CAGR of 2.5%. The reasons for this are the following: the need for reliable electricity in various industries, such as construction, telecommunications, and medical care, especially in the region where the electricity grid is not stable. In addition, the hybrid power system, which combines diesel generators and wind power and other forms of electricity, is becoming popular, which will be further accelerated by the trend towards energy saving and the reduction of carbon dioxide emissions. Moreover, the major players in the diesel-engine market, such as Caterpillar Inc., Cummins Inc., and Kohler Co., are actively investing in research and development, and they have launched a series of new products. Strategic alliances and collaborations are also common. For example, the company has developed a smart generating set that uses the Internet of Things to monitor and manage power generation. These innovations not only enhance the efficiency of the company's business, but also conform to the world's energy-saving development trend, which will further promote the development of the market.

Regional Market Size

Regional Deep Dive

The market for diesel generators is characterized by different dynamics across the different regions, influenced by factors such as energy demand, regulatory framework, and technological advancements. In North America, the market is driven by a strong industrial sector and a growing emphasis on emergency power solutions. Europe is experiencing a shift towards cleaner energy, which will affect the demand for diesel generators. In Asia-Pacific, the market is characterized by rapid urbanization and industrialization, which is driving the market. The Middle East and Africa are facing unique challenges, such as lack of basic infrastructure and access to energy, while Latin America is focusing on energy diversification and sustainable development.

Europe

- In Europe, the market is being shaped by stringent environmental regulations, such as the EU's Green Deal, which is encouraging the transition to hybrid and renewable energy solutions, thereby impacting the traditional diesel generator market.

- Key players like Atlas Copco and Kohler are investing in R&D to create low-emission diesel generators, aligning with the region's sustainability goals and responding to the growing demand for cleaner energy solutions.

Asia Pacific

- The Asia-Pacific region is experiencing rapid industrialization, particularly in countries like India and China, where the demand for diesel generators is being driven by the need for reliable power supply in manufacturing and construction sectors.

- Government initiatives, such as India's 'Make in India' program, are promoting local manufacturing of diesel generators, which is expected to enhance market growth and reduce dependency on imports.

Latin America

- Latin America is focusing on energy diversification, with countries like Brazil and Mexico investing in diesel generators as part of their energy mix to support economic growth and infrastructure development.

- Regulatory frameworks are evolving, with governments encouraging the adoption of cleaner technologies, which is leading to innovations in diesel generator designs that meet both performance and environmental standards.

North America

- The North American market is experiencing a strong growth in demand for diesel generators, especially in the critical sectors of health and data centers, where Caterpillar and Cummins are the leading companies.

- Recent regulatory changes aimed at reducing emissions are pushing manufacturers to develop more efficient and environmentally friendly diesel generators, with the EPA's Tier 4 standards significantly influencing product design and technology.

Middle East And Africa

- In the Middle East and Africa, the diesel-generator market is influenced by the ongoing construction and mining projects and the need for reliable power in remote areas. Perkins and FG Wilson are active in these regions.

- The region's unique challenges, such as political instability and fluctuating oil prices, are prompting investments in more resilient and efficient diesel generator technologies to ensure energy security.

Did You Know?

“Did you know that diesel generators can operate efficiently in extreme temperatures, making them a preferred choice for remote locations and harsh environments?” — International Energy Agency (IEA)

Segmental Market Size

The diesel-generator market is stable, and serves as a critical power-backup solution for many industries. The main drivers of demand are the increasing need for stable power supplies in regions with unstable electricity grids, and the growing industrial sector in developing economies. Also, energy-security and infrastructure-development policies will increase the relevance of this market. The current stage of diesel-generator development is mature, with companies such as Caterpillar and Cummins leading in both technology and market share. Nevertheless, the market is still growing, particularly in Africa and Southeast Asia, where power grids are weak. The main users of diesel generators are the construction industry, telecommunications operators, and hospitals, where a steady power supply is critical. The growing focus on energy conservation and government regulations on energy efficiency will continue to support growth. Likewise, the trend towards higher fuel efficiency and reduced emissions of harmful substances will shape the evolution of this market.

Future Outlook

The market for diesel generators will grow at a steady rate from 2024 to 2035. The market value is expected to increase from $22.77 billion to $30 billion, with a compound annual growth rate (CAGR) of 2.5%. The continuous use of diesel generators in various fields, such as construction, telecommunications, and emergency power supply, especially in regions with unreliable grids, will continue to drive the growth of the market. As the economy develops, the need for reliable power supply will also increase. The penetration rate of diesel generators will rise, especially in the developing countries that attach importance to the construction of public facilities. The future of the diesel generator market will also be influenced by the introduction of new technology and the formulation of new policies. The new technology for fuel saving and emissions reduction is expected to bring new opportunities for the development of diesel generators and will be in line with the trend of sustainable development. The reduction of carbon emissions will lead to a shift towards hybrid systems, which combine diesel generators and other energy sources. The development of smart grids and the emphasis on energy security will also affect the market.

Leave a Comment